Affordable purchase and cost rental: The role of The Housing Agency

Significant work is underway to deliver affordable housing at scale. The Affordable Housing Act 2021 represents the first standalone affordable housing legislation in Ireland, while Housing for All, the Government’s new housing plan for Ireland, outlines a commitment to supporting homeownership and increasing affordability. Bob Jordan, CEO of The Housing Agency, discusses two key means by which these objectives will be achieved: affordable purchase and cost rental.

Government policy is committed to making available housing that is affordable for households across a wide range of income groups. The Affordable Housing Act 2021 provides for two affordable purchase schemes. These seek to address the affordability gap that exists for moderate income households who are constrained from accessing sufficient finance to purchase homes at open market prices.

Primarily aimed at first time buyers, the two new options are summarised in Figure 1.

The Local Authority-led Affordable Dwelling Purchase Arrangement will allow local authorities with affordability issues to offer homes for sale. Affordable homes will be developed by local authorities or in partnership with approved housing bodies (housing associations), the Land Development Agency and housing developers. The discount from the open market value will be achieved by a combination of low-cost land and other specific State funding. The local authority will hold an equity share equal to the percentage discount on the open market value and the affordable homes will be offered for sale to eligible households.

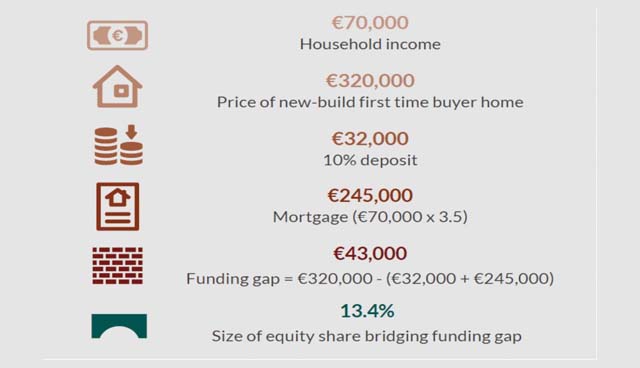

“We know that the current mortgage lending rules, three-and-a-half times an individual or couple’s gross annual income, does not bring some people far enough up to be able to buy a property on the open market, so the idea of the equity share is to bridge that gap,” Jordan says. “The idea is to enable first-time buyers to enter the market and to enable local authorities to produce homes at a price people can afford in their own area, at least 15 per cent below the purchase price on the open market.”

The First Home national shared equity scheme will be operated in cooperation with participating banks. Eligible purchasers will be able to buy new homes for sale on the open market that are below the relevant location-based price caps. An equity share will be available to an eligible purchaser where there is a shortfall between their mortgage capacity and the new home price. The equity share will be owned by a special purpose vehicle jointly funded and overseen by the participating banks and the State. The equity share can be bought out at any time and an annual charge will apply after year five to the equity share value.

An example of how the shared equity schemes will work can be seen in Figure 2.

Cost rental

Home ownership can often be the focus for affordable housing. However, a key element of achieving affordable housing in many countries is the development of a cost rental sector. Over time, this approach can provide a significant amount of housing that offers a more affordable option to many households. It is a more sustainable rental model where homes and rental income flows can be used to leverage further investment. The Act contains provisions to facilitate delivery of cost rental housing which will be developed mainly by local authorities, approved housing bodies and the Land Development Agency. The establishment of the cost rental model is intended to promote an increased supply of affordable rental homes in areas where there is a high demand for housing. The Housing Agency has been central to developing a vision for cost rental in Ireland. We promoted the concept to policymakers in the Irish housing sector when we co-hosted an exhibition on the Vienna model of cost rental with Dublin City Council in 2019.

“Cost rental is hugely important, as it might well represent a once in a generation oppportunity to introduce a new form of tenure in Ireland,” Jordan says. “Back in 2004, NESC recommended the introduction of cost rental in Ireland, so this has been a long journey. What makes cost rental different is that it’s about rents based on the costs of construction, management and maintenance of the house. The idea is obviously that those rents would be far less than the market rents and would certainly be starting out at 25 per cent below market.

“It’s a success story all over Europe. The idea is that delivering cost rental at scale will have a moderating effect on overall market rents. Recently the Housing Agency and Housing Europe produced a study of three countries where it has been very successful: Austria, Denmark, and Finland. In those countries there’s a very large stock of cost rental accommodation: 17 per cent in Austria, and 20 per cent in both Denmark and Finland. These are very successful examples from which we have a lot to learn.”

The overall aim is to have homes available for rent at levels that are substantially below market rent while sufficient to meet the financing and on-going management and maintenance costs for the owner. The Minister for Housing has approved Cost Rental Equity Loan (CREL) funding for the initial cost rental homes to be delivered by approved housing bodies over the next year. The Housing Agency is playing a key role here by providing the CREL funding as a secondary loan for 30 per cent of the capital cost, with the Housing Finance Agency funding the balance of 70 per cent. The Housing Agency is also facilitating the delivery of cost rental homes by two approved housing bodies, Respond and Tuath, on public land, in partnership with Dún Laoghaire-Rathdown County Council. Homes must be designated as cost rental dwellings for a minimum period of 40 years with rents calculated to cover the cost of housing delivery, finance, management and long-term maintenance.

Cost rental homes will be available for rent to households who meet specific income eligibility criteria. They will be provided unfurnished, although they will be comparable to private rental homes in all other respects.

The new legislation now in place will drive the delivery of affordable homes for purchase and to rent.

Jordan concludes: “There is a strong government commitment to increasing capacity and expertise in the housing sector. We’re building public confidence and understanding, bringing in new providers. We at The Housing Agency are excited to be playing our part in this journey.”

T: 01 656 4100

E: communications@housingagency.ie

W: www.housingagency.ie