Healthcare infrastructure in Ireland: An overview

With a planned investment portfolio of €5.7 billion under the National Development Plan to 2025, the Irish Government has commissioned analysis of healthcare infrastructure in the State, which has found notable regional disparity in infrastructure capacity and built infrastructure in good but ageing condition.

Two separate reports were published in September 2022 as part of the Government’s Healthcare Capital Investment in Ireland series, the first of which analyses the healthcare infrastructure capacity of the State, the second of which analyses the built infrastructure of healthcare within the State.

Infrastructure capacity

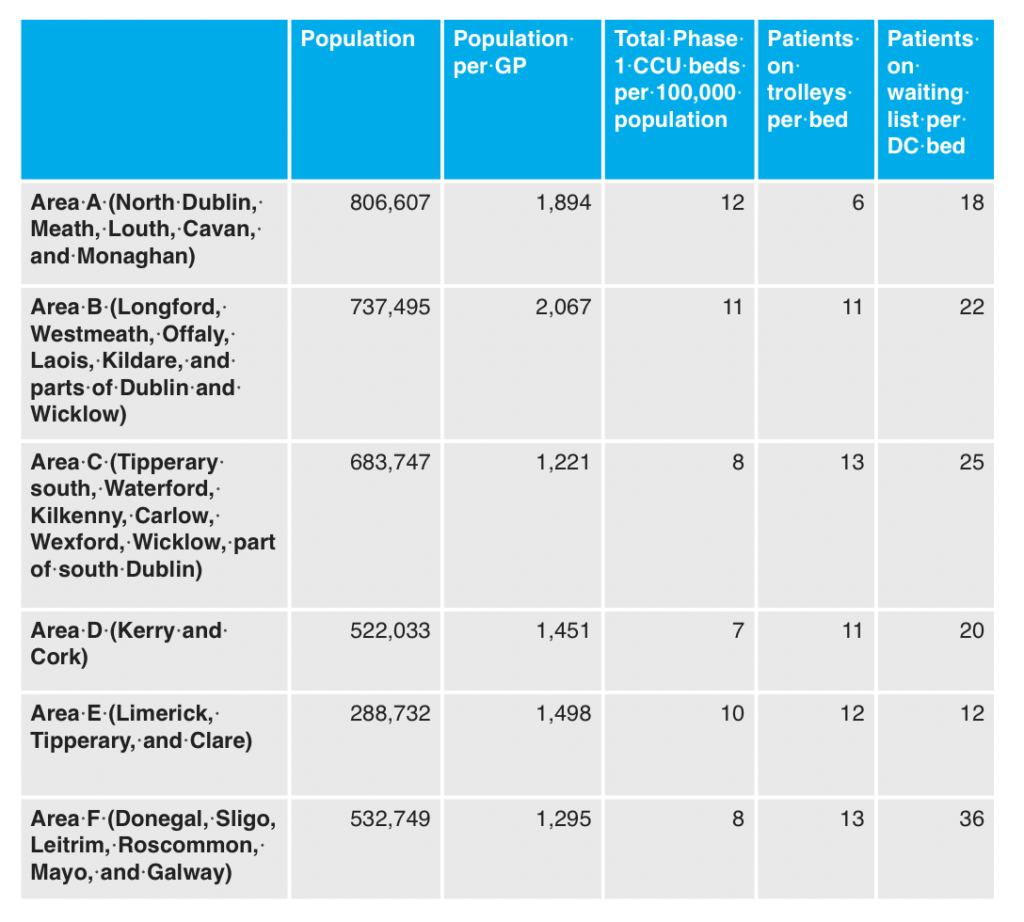

Analysis of the healthcare infrastructure capacity in the State found there to be great variation in the distribution of said capacity dependent upon the regional health area. In terms of critical care unit (CCU) beds, regional health areas A (North Dublin, Meath, Louth, Cavan, and Monaghan), B (Longford, Westmeath, Offaly, Laois, Kildare, and parts of Dublin and Wicklow), and E (Limerick, Tipperary, and Clare) were found to have “significantly more” beds relative to population than areas C (Tipperary South, Waterford, Kilkenny, Carlow, Wexford, Wicklow, part of South Dublin), D (Kerry and Cork), and F (Donegal, Sligo, Leitrim, Roscommon, Mayo, and Galway). In total, the State has 7.7 CCU beds per 100,000 of population, a rate well below the 2020 OECD average of 12, that falls as low as seven per 100,000 in area D and rises as high as 12 per 100,000 in area A.

This disparity is in part explained as being “partially reflective of the presence of national centres of excellence in some regional health areas and the associated higher acuity care provided in these hospitals”. The analysis also notes that the HSE’s multi-year plan Phase 2 looks to deliver 446 CCU beds. The report further states that the number of general hospital beds available per area is “uneven”, with F having 247 beds per 100,000 and C having 207. “The relationship between occupancy and bed capacity in each region is weak, highlighting the need for further analysis of acute care performance,” it states.

In keeping with having the highest rate of CCU beds per population, area A also has the lowest proportion of patients on trolleys per bed, six. All other regional health areas record patients on trolleys per bed in the double figures, ranging from 11 to 13, and areas F, C, and B all report using over 60 trolleys per day.

The number of patients on waiting lists per ambulatory beds available was found to be “highly skewed”, with area F having 36 patients waiting per bed and area E having 12 patients waiting per bed, and other areas ranging from 18-25 patients waiting per bed. Such disparity, the report says, points to the need to facilitate greater inter-regional referrals, and the need to explore the utilisation of day beds on a seven-day basis rather than the current five-day basis.

Levels of access to radiological equipment also varies across areas, with F having 8.4 X-rays per 100,000 population compared to 5.5 in RHA E. “This may influence the levels of unmet need and delayed discharge in each region,” the report says. 47 per cent of X-ray machines were also found to be over 10 years old, “implying the need for investment and replacement strategy for these assets”.

Built infrastructure

The second report, an analysis of the healthcare sector’s built infrastructure, found the capital stock of both community and acute facilities to vary significantly, with a “large proportion” of both – 70 per cent of the community estate and 50 per cent of the acute care estate – built over 40 years ago, which “likely has negative associated impacts on maintenance costs, patient safety and efficiency”. The quality of the stock was, however, found to be good in the community care portfolio, where over 90 per cent of all sites received a score of B or above across all four categories measured.

In total, the State has 7.7 CCU beds per 100,000 of population, a rate well below the 2020 OECD average of 12, that falls as low as seven per 100,000 in area D and rises as high as 12 per 100,000 in area A.

The report notes that €1 billion of the €5.7 billion to be invested is to be spent on the replacement and refurbishment of the HSE residential estate in order to meet Health Information and Quality Authority standards. The majority of this spending will be accounted for by the acute care portfolio, which fares much worse in terms of quality of stock, with just 43 per cent of sites having the recommended B rating, and 44 per cent of the portfolio being below the recommended rating for functionality. €887 million is recommended for spending on acute care settings, with the remaining €121 million to be spent on community care.

The report also notes the portfolio of vacant buildings within the HSE estate, with portfolios of vacant buildings over 20,000m2 in five counties, ranging from 50,000m2 in Galway to 25,000m2 in Dublin. The report states that the HSE is currently engaging with the Land Development Agency on the potential disposal of these portfolios and that “the utilisation of these sites for other purposes where suitable may alleviate issues around housing and other societal issues”.

In terms of energy efficiency, just 28 per cent of the top 120 energy users within the HSE portfolio exceed a Display Energy Certificate rating of B3, with the report stating that it is “likely that significant investment will be required to achieve carbon abatement targets in the health sector in line with government objectives”.

The report concludes by stating that, along with the aforementioned investment, further research will be needed to determine where to next for health infrastructure, and that the Healthcare Capital Investment in Ireland series will now provide a baseline for such research.