Composition of purchasers of new homes

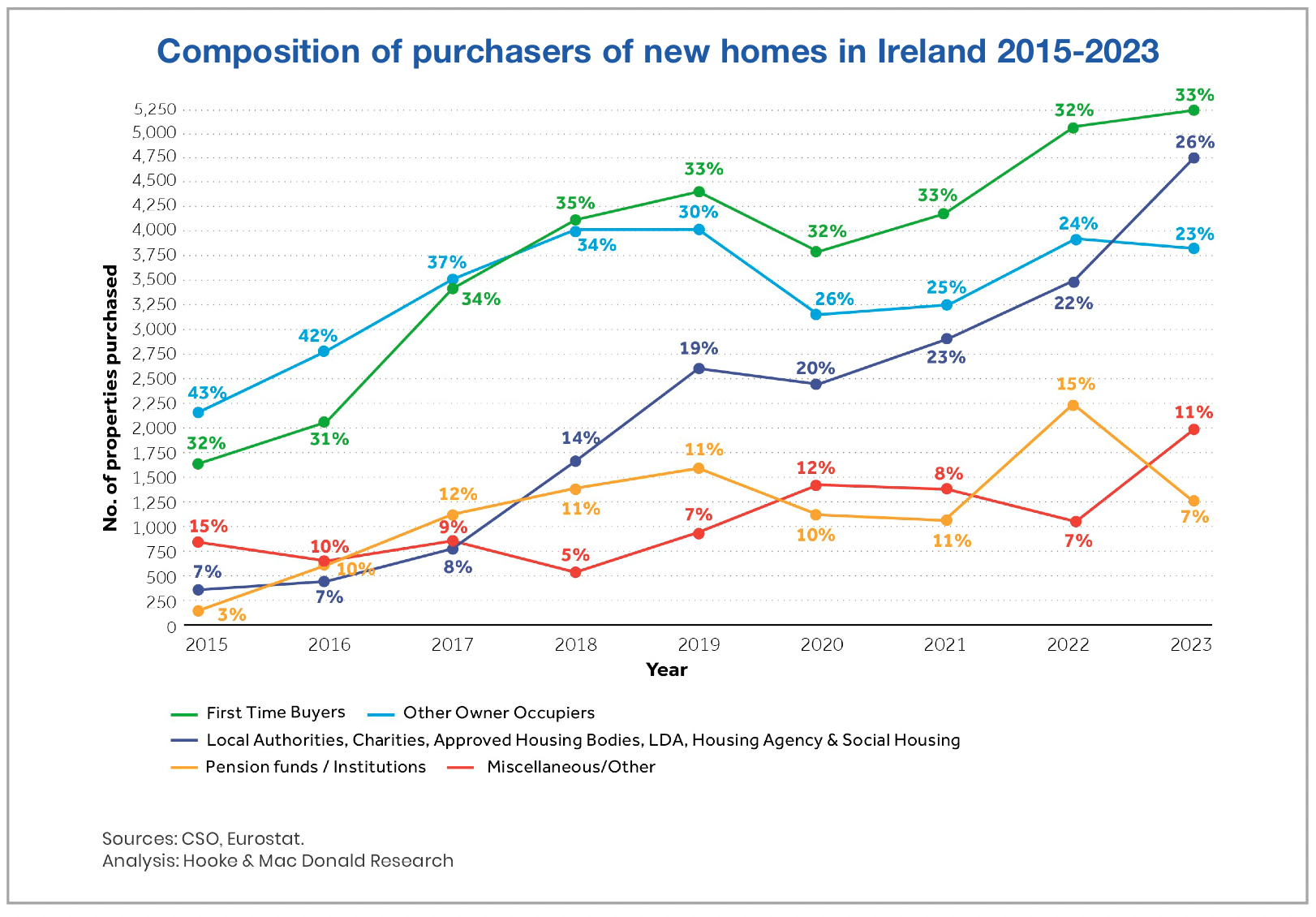

Hooke & MacDonald Research has tracked the composition of purchasers of new homes in Ireland from 2015 to 2023.

First time buyers have consistently been the leading purchasing group. In the latest statistics released by the CSO first time buyers increased their percentage of new home purchases from 32 per cent to 33 per cent. Other owner occupiers constituted 23 per cent, down from 24 per cent in the previous year.

The biggest mover in the latest figures is the public sector category which includes the LDA, Approved Housing Bodies (AHB), local authorities, and The Housing Agency. This has now become the second biggest purchaser of new homes, at 26 per cent of the total, increasing from 22 per cent in 2022 and an 86 per cent increase from 14 per cent in 2018. At the present rate of activity in the various sectors, it is likely that the public sector will be the leading purchaser of new housing stock within two years.

The CSO figures for purchasers of new homes are based on sale closures so there is a time lag between date of purchase and date of sale closure. This can conceal trends in the marketplace, for instance in the case of forward purchases of apartment blocks in 2021 and 2022, which only appear in 2023, 2024 or later. This is reflected in the purchases of properties by pension funds and institutional entities/funders, both domestic and foreign, whose share of purchases in the CSO figures has fallen by 53 per cent from 15 per cent in 2022 to 7 per cent in 2023. However, the reality is that purchases by this category is heading for zero due to the unfavourable conditions in Ireland for private funding of the housing market.

The dramatic movement by private funders away from the Irish housing market as shown by these latest figures is a disaster for the Irish housing market and particularly for the private rented sector, which is already negatively impacting on the supply and cost of accommodation and which is on course to deteriorate further this year and in the coming years. The reality is that institutional entities have been responsible for funding the construction of over 20,000 apartments, mostly in Dublin, in the past seven years providing accommodation for approximately 50,000 people based on an estimated occupancy of 2.5 persons per property. If these had not been built the rental market would now be in a far worse position than it currently is in terms of supply – these properties would not have been built if it were not for these sources of capital.

The State can only fund less than half of the €20 billion required annually for the funding for a minimum of 50,000 new homes so it is imperative that conditions are created as a matter of urgency for institutional funding to re-enter the market and make up the difference in the funding shortfall. The damage done by the 2 per cent rent cap is now plain to see. It needs to be ended now. The convoluted replacement for it proposed by The Housing Commission would be most unhelpful and unwieldy.

Funding by the Government for the different typologies of housing needing in the public sector is an absolute necessity and must continue. It is such a pity that funding for the private sector is being impeded by misguided and failed policies preventing private institutions from supporting the private rental market in Ireland.

The Department of Finance has produced a report which contains a very significant and honest analysis of how the housing programme for the State has to be funded. If supply is to be ramped up to meet the housing supply targets, measures need to be introduced to counter the alarming inactivity of institutional funders in the industry and to actively encourage and substantially increase their involvement.

Hooke & MacDonald

118 Baggot Street Lower

Dublin 2

PSRA No. 001651

T: 01 661 0100

E: info@hmd.ie

W: www.hmd.ie