Exporting to the UK

A good year for Irish exports culminating in an increase of €654 million over the past 12 months is likely to recede in the second half of 2016 as the impact of Brexit and subsequent weakness in sterling start to take effect.

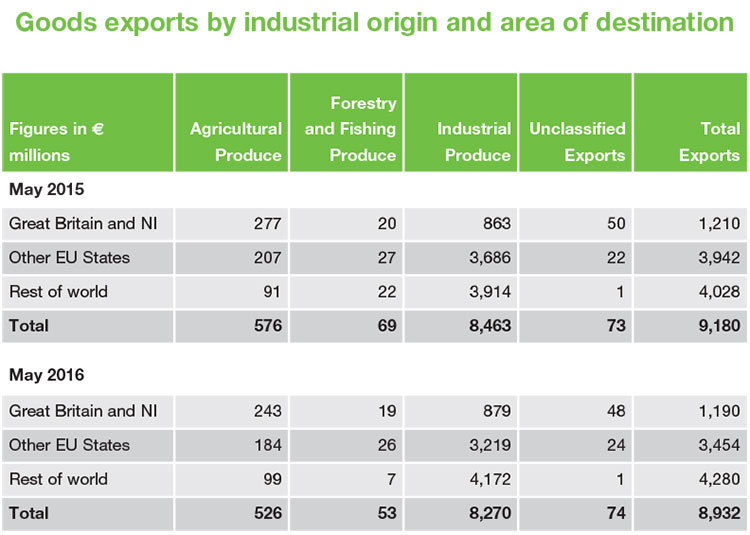

Recent CSO figures point towards a good year for trade. Latest figures for June show that exports rose by 5 per cent to €9.5 billion and imports fell 8 per cent to €5.05 billion, escalating the trade surplus for the month by 22 per cent to €4.5 billion. The value of exports for the six months of 2016 rose by 1 per cent from the same period in 2015 to €55.4 billion. However, these figures appear to be propped up by high performing month for exporting medical and pharmaceutical products, a sector which varies widely month to month. In June it rose by €298 million on the previous month. Exports of electrical machinery, apparatus and appliances increased by €266 million to €509million, while exports of petroleum, petroleum products and related materials decreased €85 million. Analysing the figures, Davy economist Davy Mac Coille said: “Excluding volatile pharmaceutical goods, exports are up just 1.2 per cent in the first half of 2016 compared with the 16 per cent rise in 2015. This outcome chimes with manufacturing PMI surveys, which suggested that sterling’s weakness, uncertainty on Brexit and weaker global manufacturing are weighing on exports. So we still expect net trade to make a smaller contribution to Irish GDP growth through 2016 and 2017.”

As Ireland’s largest export partner, Britain’s position outside of the EU is likely to have a negative effect on the Irish economy, however, under what guise their exit eventually takes place will be crucial to the €1.5 billion in transactions occurring between the two each week. At the last count, Ireland exported nearly €14 billion of goods to the UK in 2015 and over €20 billion of trade in services in 2014, the last recordied statistics, representing close to 17 per cent of total GDP.

A recent study by Teagasc suggested that Irish agribusiness, the most vulnerable sector, could be set to lose around €800 million per year when Britain triggers Article 50. In 2015 €5.1 billion of farm produce was exported to Britain. Britain bought €1.1 billion of Irish beef, €1 billion of dairy produce and 60 per cent of pig meat, to an overall value of €3.3 million a year.

Currently Ireland is the UK’s largest export market in food and drink and second largest market in clothing, fashion and footwear. Trade in other sectors continues to grow but the true extent of the impact of a Brexit on Ireland’s economy will only be uncovered in the detail of trade deals established between the EU and the UK, as Ireland prepares for its largest trading partner to be outside the current agreements.

Source: CSO