Affordable Housing Act 2021: Housing support schemes

The Affordable Housing Act 2021 enacted on 8 July 2021 was described as “the most comprehensive standalone affordable housing legislation in the history of the State”.

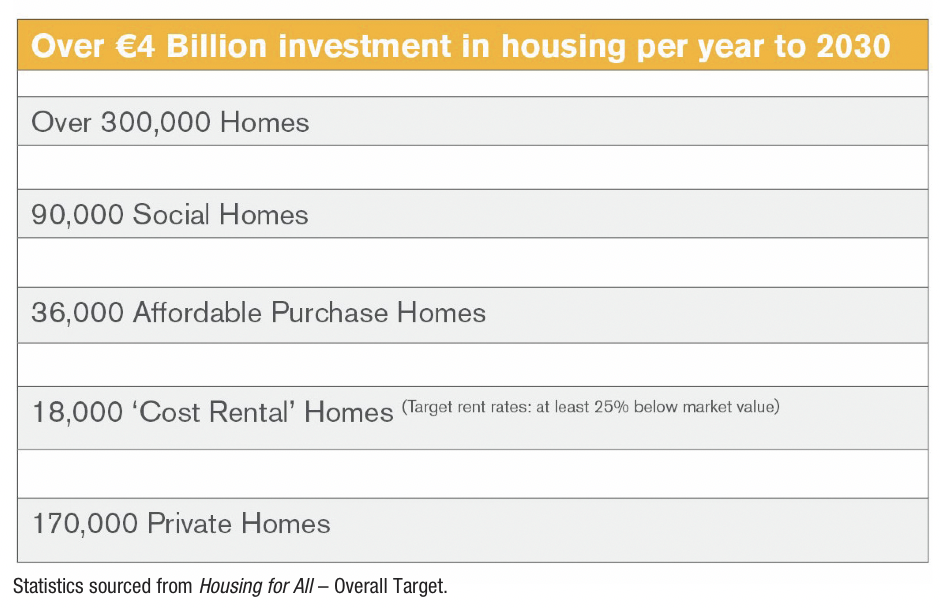

The Act provided for a range of new measures as part of a long-term strategy to target affordable housing and bring forward supply led policy measures supported by ambitious capital funding, with €4 billion overall allocated in Budget 2022, €2.6 billion of which being capital funding for 11,820 social homes. Since its enactment a series of schemes have been launched as part of the Housing for All strategy led by The Housing Agency on behalf of the Department of Housing, Local Government and Heritage.

Cost Rental Equity Loan (cost rental): The so-called “Vienna Model”, developed to support those people earning above social housing limits (salary cap of €66,000 for properties in Dublin and €59,000 elsewhere) with long-term security of tenure where tenants can avail of rents at least 25 per cent below the private market. Cost rental loans are made available to approved housing bodies (AHBs) alongside debt finance from the Housing Finance Agency (HFA) under a coordinated arrangement whereby both the HFA and The Housing Agency jointly fund the purchase of cost rental homes in new build developments. Homes are designated as cost rental homes for a minimum period of 50 years thereby ensuring their long-term availability and affordability. By offering long-term debt finance through both the HFA and The Housing Agency, AHBs are able to offer these homes at a discount to market rent. 719 cost rental homes have been delivered via AHBs since the commencement of the scheme in late 2021 with a significant number planned and under development.

The cost rental product is currently being expanded to provide an additional State equity investment alongside the existing cost rental loan following recommendations from a working group on cost rental.

First Home Scheme: a shared-equity scheme in partnership with participating banks (AIB, EBS, Haven, BOI, and PTSB) to assist first-time buyers to purchase new-build homes, whereby up to 30 per cent of the value of the home can be funded by the First Home Scheme under a shared equity arrangement subject to the entitlement of the homeowner to repurchase or redeem the equity interest held by the scheme in the property.

Croí Cónaithe (Cities) Fund: a fund established to encourage greater activation of planning permissions for apartments of four floors or more than 40 units or more, by addressing construction viability in locations in Dublin, Cork, Limerick, Galway, and Waterford where there is a demonstrable viability gap in the cost of building the apartments. The scheme makes available a contribution of up to €120,000 per apartment to the developer as the apartments are completed. The funding provided enables the sale of the completed apartments to purchasers at a reduced cost, provided they live in the apartment for 10 years. If a purchaser sells the apartment within 10 years a clawback of funding support will be triggered based on a pro-rata calculation of the increased value of the apartment on sale against the funding amount provided to the apartment under the scheme.

Croí Cónaithe (Towns) Fund: a fund to support servicing sites and renovating vacant homes in regional towns and villages whereby grant funding or assistance is provided to homeowners:

- Vacant Property Refurbishment Grant: a grant of up to €50,000 (with the possibility of an additional €20,000 where the property is listed on a Derelict Sites Register) to support the refurbishment of vacant and derelict properties. Provided a homeowner occupies the property or makes it available to rent for a period of 10 years no repayment of the grant is required. However, a clawback of the entire grant is required if the property is sold within five years or 75 per cent of the grant between years five and 10. The clawback is secured by a mortgage on the property, if there is an existing mortgage on the property the grant mortgage ranks as a second mortgage behind the mortgage lender.

- Ready to Build Scheme: involves the making available of a discount to market value on the purchase price of a serviced site by local authorities, to individual purchasers for the building of their home which will be their principal private residence. It is intended that local authorities will develop sites either in their control or via purchase and make them available for development by providing services and access to the sites. The level of discount to the individual will depend on the level of servicing cost incurred by the local authority before the sale of the site with discounts up to a maximum of €30,000. If the home is sold within 10 years, a clawback of the purchase discount is triggered (being 100 per cent of the discount if within five years or between years five and ten a clawback of 75 per cent of the discount applies).

Affordable Dwelling Purchase Arrangements: this is a local authority affordable purchase scheme to allow Local Authorities to make new homes available for purchase by eligible applicants at reduced prices. In return, the local authority will take a percentage equity stake in the affordable purchase home. The council’s equity stake will be equal to the discount of the purchase price from the full market value of the home. If an eligible applicant purchases a home at a 20 per cent discount, the local authority will take a 20 per cent equity stake, and this will be documented in an affordable dwelling purchase agreement.

Local Authority Home Loan Scheme: a Local Authority Home Loan is a government backed mortgage for first-time buyers can make available up to 90 per cent of the market value of the property. The maximum loan amount is determined by where the property is located. Recently announced increased income limits apply of €70,000 for single applicants or €85,000 joint applicants.

Secure Tenancy Affordable Rental Investment Scheme (STAR): intended to offer cost rental dwellings at scale (minimum of 10 units), the scheme is supported by €750 million for the delivery of 4,000 cost rental homes by 2027. Under the STAR scheme an equity investment may be made by The Housing Agency of up to €175,000 per home in Dublin or €150,000 per home elsewhere (with a possible additional €25,000 available subject to the home satisfying certain sustainability criteria in line with the EU Taxonomy Regulation). As part of the approval and eligibility criteria the assessment will involve an open book assessment of the development and operational costs to ensure a transparent review of the costs and revenues.

The scale of State investment in housing and housing supports being made available under Housing for All is unprecedented, but equally the challenges being faced in terms of the housing crisis, the war in Ukraine, inflation and rising interest rates are equally significant. Housing delivery is increasing and there are signs that the pipeline supply of homes through the combination of supports has the potential to deliver on the significant pledges made under Housing for All.

Simon O’Neill, a partner in the Banking and Finance team in Philip Lee LLP, is advising on a number of housing projects and the schemes made available under Housing for All and the Affordable Housing Act 2021.

Contact us

T: 01 237 3700

E: info@philiplee.ie

W: www.philiplee.ie