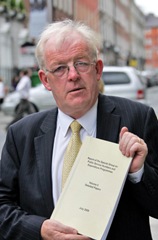

An Bord Snip Nua

The Report of the Special Group on Public Service Numbers and Programmes, known as An Bord Snip Nua, was published on 16 July, detailing recommendations for cutting public expenditure totalling €5.3 billion. Fundamental changes in the way the public sector is structured are on the way, as Owen McQuade reflects.

The Report of the Special Group on Public Service Numbers and Programmes, known as An Bord Snip Nua, was published on 16 July, detailing recommendations for cutting public expenditure totalling €5.3 billion. Fundamental changes in the way the public sector is structured are on the way, as Owen McQuade reflects.

When An Bord Snip Nua was conceived back in November last year, the extent of the economic crisis facing the country was still unclear. Late in 2008, Finance Minister Brian Lenihan hoped that savings of €5 billion would be enough to balance the Budget within three years. We now know that €5 billion will be nowhere near enough with the amounts given to the banks dwarfing this figure. This year the state will be spending €20.3 billion more than it earns despite three Budgets over the past year.

The numbers employed in the public service have increased substantially over the period since 2001. An overall increase of more than 49,000 corresponds to an increase in expenditure of around €2.25 billion and, if accrued, pension costs would add another €1 billion to this figure. While the increases correspond to increased service delivery in many sectors, notably health and education, the report highlights the disproportionate increase in the ratio of senior-level grades. The recommendations in total would reduce staff numbers by 17,000.

Social welfare payments

Perhaps the most controversial of the recommendations are the proposed cuts to welfare payments. The report recommends a 5 per cent cut to all social welfare payments, which add up to be the largest expenditure area for the Exchequer at €21 billion in 2009, followed closely by public sector pay and pensions at around €20 billion a year.

The rationale for the cuts in welfare payments is that there has been a significant readjustment in both public and private sector wages over the period 2008-2009. The public sector pension levy in 2009, on average, reduced wages by 7.5 per cent. A survey by the Central Bank in March of this year indicated that private sector employers have reduced wages by 3 to 4 per cent. In addition the report notes that rates of social welfare payments were increased by 3 per cent in the October 2008 budget and since that time inflation has fallen. The main social welfare rates have increased significantly since 2000 over and above the rate of inflation and average industrial earnings and many social welfare rates, particularly for pensions and the unemployment allowance, are now higher in absolute cash terms than their UK equivalents. The report gives examples of welfare payments that concerned the group in terms of being disincentives to participate in the labour force. The examples included a Dublin-based couple with three children availing of a total of nearly €42,000 per annum and a couple with no children receiving €27,000 per annum. The report states that there is a “clear case for social welfare rates to be adjusted downwards in line with economic developments.”

Health and education

Education faces the prospect of the largest number of job cuts at 6,900 and savings of €746 million. Other measures will include the reduction of primary schools through mergers and a reduction in the number of third level institutions. The report recommends that average pupil-teacher ratios be increased for both primary and secondary schools, and that the number of special needs assistants and English language support teachers be reduced. This reduced number of teachers should be accompanied by a similar reduction in the funding to teacher training colleges.

Amongst the most controversial of the recommendations is that it should be much harder to get a medical card. The report identifies potential savings of €1,230 million in health with staff numbers reduced by 6,168. The report highlights the need for staff flexibility and redeployment on a compulsory basis if necessary. On the demand side recommendations include income guidelines for the medical card to be revised to the basic rate of social welfare (jobseekers’ allowance), that the monthly threshold for the Drugs Payment Scheme is increased to €125 and that a copayment of €5 is introduced for each prescription.

On the supply side an increase in competition in the provision of health care services is encouraged and it recommends that the Health Service Executive (HSE) phase out existing contracts with GPs and pharmacists. To reduce “inappropriate demand” for health services in public acute hospitals the standard charge for those presenting at A&E departments without a letter from their GP should be increased to €125.

Other areas of the public sector to face cuts in staff numbers include 1,140 Civil Service staff reductions from the agricultural sector, 594 in environment and 540 in the justice area.

Re-shaping the public sector

The report details a list of possible mergers in all sectors. It is often difficult to deliver the savings from such mergers. This has always been the case with several studies showing that although there are apparently efficiency synergies on paper they are often not delivered in practice.

A reduction in the number of government departments is recommended with the Department of Community, Rural and Gaeltacht Affairs to close and its functions transferred to other departments, and the Department of Arts, Sport and Tourism to be “critically examined”.

The face of local government could be radically altered if the report’s recommendations are followed through. All 49 town councils would be axed and the number of county councils would be cut from 34 to 22.

The McCarthy Report is certainly comprehensive in that it recommends cuts right across the public sector. It perhaps reflects McCarthy’s years as a management consultant as the report is competently put together but like most reports they are worthless unless implemented. Many of the recommendations will be difficult politically, such as the closing of half of the 703 Garda stations, mainly in rural areas. But the dire state of the country’s finances will be a driver for change.

Members of An Bord Snip Nua

Colm McCarthy, the UCD economist, chaired the panel of experts. After working as an economist in the Central Bank, the Economic and Social Research Institute (ESRI) and as a partner in DKM Economic Consultants, he returned to his alma mater as a lecturer. He was a member of the original Bord Snip in the 1980s.

Pat McLoughlin is Chief Executive of the Irish Payment Services Organisation (IPSO), which represents the payment industry. Prior to this he held a number of senior management positions in the Health Service, and was most recently Deputy Chief Executive and National Director (Hospitals) of the Health Service Executive (HSE).

Donal McNally is Second Secretary at the Department of Finance. A career civil servant who was at the Department of Industry and Commerce from 1969 to 1971 after graduating from Trinity College Dublin. He then moved to the Department of Finance and was transferred from banking to public expenditure and then to the Budget and Economic Divisions.

Maurice O’Connell is a former Governor of the Central Bank (1994-2002). Prior to this appointment he served for 32 years in the Department of Finance, reaching the position of Second Secretary General in the department’s Finance Division. During this time O’Connell held Ireland’s position on the EU Monetary Committee between

1988 and 1994. He also held the position of Director at the European Investment Bank.

William Slattery is Managing Director of financial services company State Street International (Ireland) Ltd since 2003. He previously worked for Deutsche Bank in London and Deutsche Morgan Grenfell investment bank in Ireland.

Mary Walsh is a member of the Commission on Taxation. She was previously head of PricewaterhouseCoopers’ international tax bureau in Ireland. She recently served as a member of the Barrington Group, which looked at local government reorganisation and reform.