Asset management as an ESG and sustainability enabler

Defining new models to measure success is key in transitioning our economic systems to meet our 21st century needs, writes Jenna Davis, Associate Director with KPMG Ireland’s infrastructure team.

Environmental and economic trends in the 21st century are shaping up to be very different to those of the 20th century. The exponential growth of economies worldwide is no longer sustainable and the universal success measure of GDP (or cost/time/risk for infrastructure projects) is changing. This is being driven by the planet and the impact human progress is having on the world we live in.

So, what does this mean for the future? How do we continue to live as societies that can thrive? Much of the solution lies in the built environment, the infrastructure we build and invest in to support a quality of life that is needed to allow people to innovate and be creative, hence fuelling economies.

Balancing and thriving: Achieving the UN Sustainability Development Goals

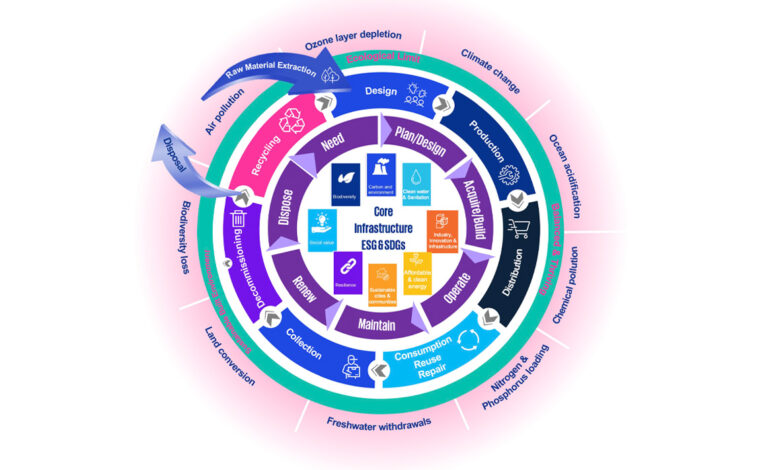

In order to address the future infrastructure needs we need to understand how economies will flex and change to become more sustainable. In response to the challenge, economist Kate Raworth sets out her vison for the future of economics as a ‘doughnut’ or ‘doughnut economics’, acknowledging the planetary limits that society must exist within referred to as the ‘ecological ceiling’.

This limit is broken down into nine ‘planetary boundaries’ beyond which Earth’s environmental systems will reach tipping point and become not only unsustainable but unliveable for future generations. Having set the upper limit, the baseline societal needs are represented as the ‘hole’ or ‘core’ of the doughnut below which basic needs are not met. This represents the essential minimum requirements for society. For example, access to clean water and energy should be a prerequisite, as should education and the opportunity to partake in an equitable economy.

When applying this concept specifically for core infrastructure requirements this can be summarised and aligned with the relevant UN Sustainability Development Goals (SDGs):

As per the UN SDGs, it is important to address the socioeconomic targets and ensure adequate investment is provided and accelerated for parts of the world where access to clean water and energy currently do not exist. The responsibility of other societies will be to recognise this need, where increased CO2 emissions and raw materials from the earth will be needed to achieve this minimum level of infrastructure. Not ideal in terms of environmental impact.

This is where the concept of offsetting becomes powerful if applied well. Places where base infrastructure is the standard will need to reduce the impact of the systems that exist already and those planned for the future. For example, societies with access to clean water should reduce any ecological impact of wastewater and encourage responsible use of water.

In Ireland, the urban and rural divide is a good example where different levels of energy or transport infrastructure is needed across the island; a system approach would allow balancing of environmental impacts across the new and existing infrastructure.

The key change in mindset is once this baseline is established, infrastructure assets are used and maintained within an ecological limit. This is the limit beyond which emissions, pollution, and other environmental impacts become unsustainable.

By considering the asset lifecycle at all stages and using methodologies such as circular economy principles such as reuse/repurpose policies for materials, we can start managing infrastructure within this band of thresholds and move towards ‘balancing and thriving’ rather than constant ‘growth and expansion’.

Measuring success: Priorities for a sustainable infrastructure system

But how do we go about transitioning to a more sustainable built environment? And how do we measure its success? GDP is such an engrained unit that future metrics will need to be just as compelling on the world stage.

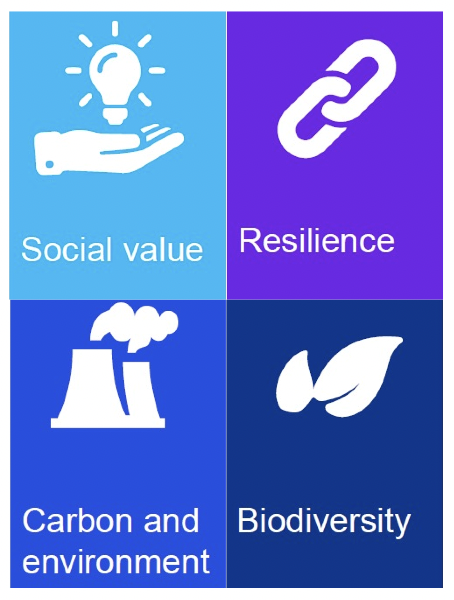

The UN SDGs offer a framework as a starting point to be more specific on what infrastructure needs to deliver to create a sustainable system. KPMG, as part of the Net-Zero Infrastructure Industry Coalition in the UK, has identified four core ESG (environmental, social, and governance) priorities for sustainable infrastructure systems:

There is an opportunity for infrastructure projects to lead the way in defining new measures of success. The traditional drivers of success; time, cost, and risk need to be prioritised with social value, resilience, carbon impact and biodiversity.

“There is an opportunity for infrastructure projects to lead the way in defining new measures of success.”

Investment plans should set these targets and include future methods of measurement in the funding. Procurement strategies need to account for ongoing policy regarding end-of-life practices to reuse and recycle materials and components. Governments and regulators must set the ambition through clear policy and commitment to reducing carbon outputs across all sectors.

The more influential mechanism to drive such policies is to factor in carbon budgets and ESG metrics when developing business cases and tendering requirements for infrastructure projects. To enable this the appraisal frameworks needs to expand beyond traditional financial and economic analysis. Measures such as biodiversity need to become the norm, not just maintaining what we have left in the natural world but improving and expanding its presence wherever we can.

Finding a starting point

So, how do we even begin to change and transition? Well, we start we are and use the knowledge we already have to make the first of many incremental changes. Asset management practices are well placed to guide the whole-lifecycle approach that is needed, and the circular economy principles start to break the problem down into areas of influence such as designing for the end in mind.

The goal is to create an infrastructure system that continues to be sustainable through the build phases right into everyday operations. Currently, ESG is a hot topic with many sectors looking for guidance on how to design and implement ESG strategies and measures. Meanwhile, the National Development Plan is ambitious and appropriately so.

The eight priorities outlined here will direct efforts towards achieving meaningful change where targets will be set to ‘balance out and offset’ rather than solely relying on profit and growth as the measure of a successful society. The KPMG Asset Management ESG Model serves a reference for all infrastructure sectors to begin making this transition.

For more information:

Jenna Davis, Associate Director,

Infrastructure, KPMG Ireland

E: jenna.davis@kpmg.ie

W: www.kpmg.com/ie