Budget 2022 unveiled a €4.7 billion package as Ireland looks to emerge from the Covid-19 pandemic, and the economic damage it wrought, in order to chart what Minister for Finance Paschal Donohoe TD called “a path to the future”.

Macroeconomic context

Budget 2022 has, of course, been formulated in the context of the ongoing recovery from the shock to international economies caused by the Covid-19 pandemic. The pandemic “has had a devastating impact on economies across the world”, but Ireland has “defied this trend as it was the only EU country where GDP grew in 2020” according to the Parliamentary Budget Office’s (PBO) pre-budget commentary.

However, while the 3.4 per cent increase in GDP in 2020 has been highlighted by the Government as evidence of its sound economic handling of the pandemic, GDP is a stat that comes with well-versed caveats. The driver for the GDP increase was the multinational enterprise sector, which the PBO indicates is “clear evidence of a dual economy in operation”.

As the pre-budget commentary explains: “Large multinational companies are generating large profits while small domestic companies are less likely to and businesses in the hospitality and recreation sectors are suffering greatly due to pandemic-related restrictions.”

This dual economy is evident in Ireland’s tax receipts for 2020, with corporation tax receipts (mainly from multinational companies based in Ireland) increasing by 8.7 per cent, almost €1 billion, reaching their highest ever level and accounting for 20 per cent of total tax revenue in 2020. Following continued strong performances in terms of income and corporation tax receipts in 2021, the Department of Finance revised its projections for the year by €1.6 billion in July, with VAT receipts also likely to exceed their forecast in 2021 as well.

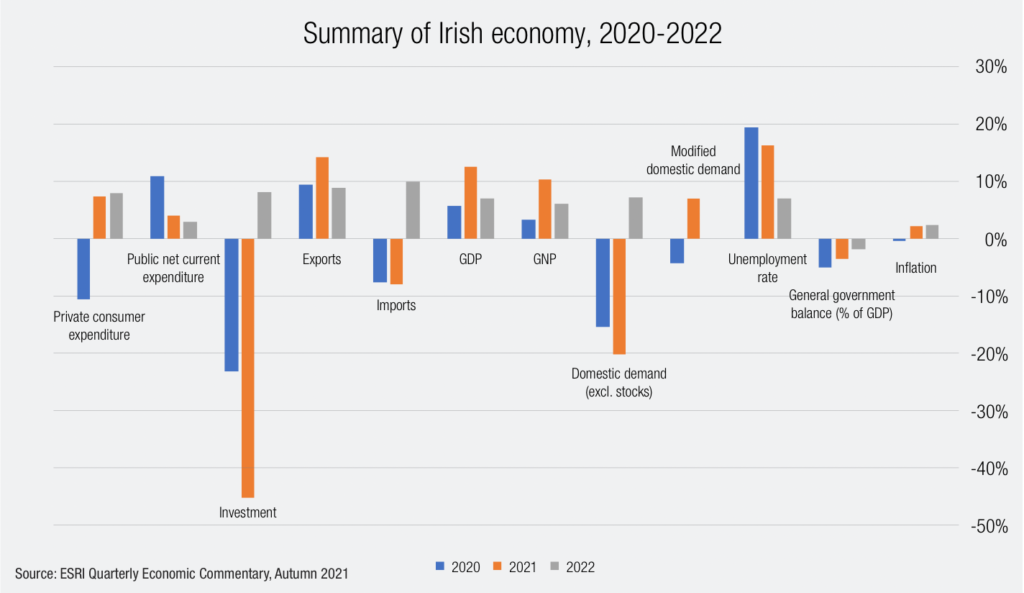

The Economic and Social Research Institute’s (ESRI) Quarterly Economic Commentary for Autumn 2021, published before the Budget, GDP predicted to grow by 12.6 per cent in 2021, with double-digit growth “mainly due to multinational related activities, in particular strong export figures”. Modified domestic demand, which the ESRI states is a “more accurate measure of underlying economic activity”, is expected to grow by 7 per cent in 2022.

Underpinning the economy is unprecedented and record levels of government spending, with special attention given to unemployment and employment supports due to the job losses and furloughing incurred during the pandemic. The Government expects to spend €90.7 billion in voted spending in 2021, including over €10 billion on Covid-related employment and unemployment supports. The Government’s Summer Economic Statement 2021 set out its intentions to grow the level of core spending at an annual average rate of 5 per cent from 2022–2025, broadly in line with the trend growth rate of the economy, predicted to reach €93 billion in 2025 as compared to just over €70 billion in 2020.

Aligned with current economic growth forecasts, this would mean a budget deficit of approximately €7.4 billion in 2025, equal to –1.5 per cent of GDP, and a gross debt of €281 billion; in comparison, April 2021’s Stability Programme Update predicted a deficit of €800 million and debt of €263 billion by 2025.

“It is not clear if the deficit path outlined in the SES meets the EU fiscal rules, specifically the structural budget balance rule,” the PBO says.

With the change in tack signalled by the Summer Economic Statement, government spending is now at all-time high levels; the Government’s Mid-Year Expenditure Report suggests that there will be approximately €1 billion per annum available for new spending measures from 2022 to 2025, once already announced capital spending increases and the cost of maintaining existing services are accounted for.

As the pandemic-related economic supports begin to be tapered down, there are many issues facing the Government. Chief among these is the health sector, where the cost of reducing waiting lists, the implementation of Sláintecare, and the cost of guarding against any future cyberattacks similar to the one seen this year will be paired with ongoing cost of the pandemic. “It is important that these are addressed so that the impact of the pandemic does not lead to further pressures in healthcare,” the PBO says.

Long-term issues facing Ireland such as a just transition to a less CO2-heavy economy and the ageing of the population will also need to be addressed, with reform of the State pension system becoming an increasing area of concern for forecasters. Reduction of emissions and a shift towards a green economy will require significant spending; capital expenditure is expected to be almost €11 billion in 2022 and increase to €13.4 billion by 2025.

The PBO states: “There are challenges around this increased level of spending including the capacity to spend the money; having a supply of projects that are ready to go and rising prices in the construction sector driven by labour and input shortages. Failure to meet these challenges could mean that the increased level in spend will not be matched by the desired increase in outputs.”

In a break from the orthodoxy of Irish governments, but in line with global trends, the Housing for All plan signalled the tri-party coalition’s willingness to invest heavily in areas that require public investment. The plan contains 213 actions and a proposed average annual spend of €4 billion in funding over five years from 2021 to 2025. The Exchequer funding element is expected to be €12 billion (capital spending) over the five-year period, almost triple of the €4.75 billion spent over the period 2016–2020.

The PBO states that the fiscal strategy articulated by the Government “suggests few changes on the tax side especially in Budget 2022” but notes that the “permanent increase in spending over the medium-term suggests a need to also increase tax revenue by broadening the tax base, reducing tax reliefs and/or increasing rates, while at the same time reducing the reliance on multinational companies”. The Commission on Taxation and Welfare is due to report before Budget 2023 and will be expected to address these issues.

Budget 2022

Upon its formal unveiling on 12 October, Budget 2022 delivered a €4.7 billion total package made up of €4.2 billion in expenditure and €500 million in tax measures, with €1.5 billion of this being new commitments or tax changes and €1 billion in direct Covid-19 funding. Key points in the area of taxation include: a €520 million reduction of income tax receipts due to the increasing of the standard rate band by €1,500 and the increasing of the personal tax credit, employee tax credit and earned income credit, all by €50; the retention of the reduced VAT rate of 9 per cent for the hospitality sector until the end of August 2022; and the increasing of the ceiling of the second rate band of the Universal Social Charge from €20,687 to €21,295.

For workers, the minimum wage has risen 30 cent to €10.50 an hour and an income tax deduction of 30 per cent of the cost of vouched expenses for heat, electricity and broadband, an increase from 10 per cent, for those who work remotely will also be applied. The Employment Wage Subsidy Scheme will remain in a graduated format until 30 April 2022 and close to new employers from 1 January 2022.

“For businesses looking to the future, this Budget backs you. That future, for individuals, for families, and for businesses, is based on secure public finances. We make further progress to that goal in this Budget. Over the past year and a half, we made the right choices at the right times: let us now do that again.” Minister for Finance Paschal Donohoe TD

In terms of housing and rent, the Government announced: the new 3 per cent Zoned Land Tax, to be calculated based on the market price of the land in question, to encourage the use of land for the building of homes; the Help-to-Buy scheme will continue throughout 2022; €174 million will be spent on supporting the direct delivery of over 4,000 affordable hoes in 2022; and a commitment to an additional 14,000 Housing Assistance Payment (HAP) tenancies and 800 Rental Accommodation Scheme (RAS) tenancies. €194 million has also been pledged to homeless services.

Climate measures taken in the Budget include the increase of carbon tax by €7.50 per tonne to €41. Petrol and diesel costs were also increased, with 60 litres of petrol and diesel increasing in costs by €1.28 and €1.48 respectively; these increases were instant, while all other fuels will have this increase applied from 1 May 2022. €5,000 of relief will be offered for battery electric vehicles until 2023 and vehicles registration tax will see increases ranging from 1 per cent for vehicles in bands 9–12 and 4 per cent for those in bands 16–20. The Accelerated Capital Allowance scheme for gas and hydrogen powered vehicles and refuelling equipment has also been extended for three years. Lastly, a €202 million fund for people to improve the energy efficiency in their homes in 2022 was also announced. €360 million will also be allocated to boosting active travel and greenways.

The funding of public services and infrastructure will include the spending of over €1.4 billion on the development of public transport networks, €100 million for disability services, €2 million to assist community safety projects and €30 million for protection and renewal of roads. 800 additional Gardaí and 400 civilian Garda staff are to be recruited, with a 20 per cent increase in the Garda Mountain Bike unit. Funding will also be delivered for the establishment of a Gambling Regulation Authority.

In health, free GP care is to be extended to children aged six and seven as part of phased plans to roll out free GP care to all children under 12, and free contraception for women aged 17–25 will be rolled out from August 2022. €250 million will be pledged to address waiting lists, €30 million of funding will be provided to the Department of Health for areas hit hard by the pandemic such as palliative care, mental health, and disability services, and €10.5 million will be provided for 19 additional critical care beds in 2022, which will bring the total ICU beds to 340, falling someway short of the planned 446 announced by Minister for Health Stephen Donnelly TD in December 2020.

Education will see the hiring of an additional 350 teachers, a plan that is expected to reduce the teacher pupil ratio from 25 to 24 pupils. 980 additional special education teachers and 1,165 special needs assistants. Funding has been pledged for the delivery of 200 school building projects, along with €30 million for the school transport scheme and €18 million to expand the DEIS programme and another €4 million to extend hot school meals to more DEIS primary schools. €50 million will be made available in ICT grants for primary and post-primary schools. For third-level students, the maintenance grant has been increased by €200, with the qualifying income threshold expanded by €1,000 and the qualifying distance reduced from 45k to 30km. The creation of 20,000 new further education and training places has been pledged, along with the abolition of the €200 contribution fee for post-Leaving Certificate courses.

Analysis

The reception of the Budget has, of course, been mixed. Sinn Féin’s finance spokesperson Pearse Doherty TD noted that the additional allocation on housing of €400 million fell someway short of the ESRI’s call to double capital investment in the area and criticised an additional spend of €300 million in health, saying that the €1 billion figure mooted included €700 million of previously announced actions focused on maintaining current levels of delivery. On the tax measures included, Doherty said: “The measures they have introduced today, for example the indexation of the standard rate band, cost over €300 million. It leaves behind two million income earners that don’t benefit from this at all… We would argue that this isn’t a targeted approach.”

However, the Budget has been largely welcomed by the business sector in Ireland, with the retention of the corporate tax rate for domestic SMEs and the exemptions to the rate for certain start-ups welcomed. While the hospitality sector has expressed its disappointment that the 9 per cent VAT rate was not made indefinite, the reorganisation of tax bands has also been welcomed in the business sector, with those approving arguing that the move will decrease tax burdens on income earners and ease the impact of the increasing cost of living on those earners.

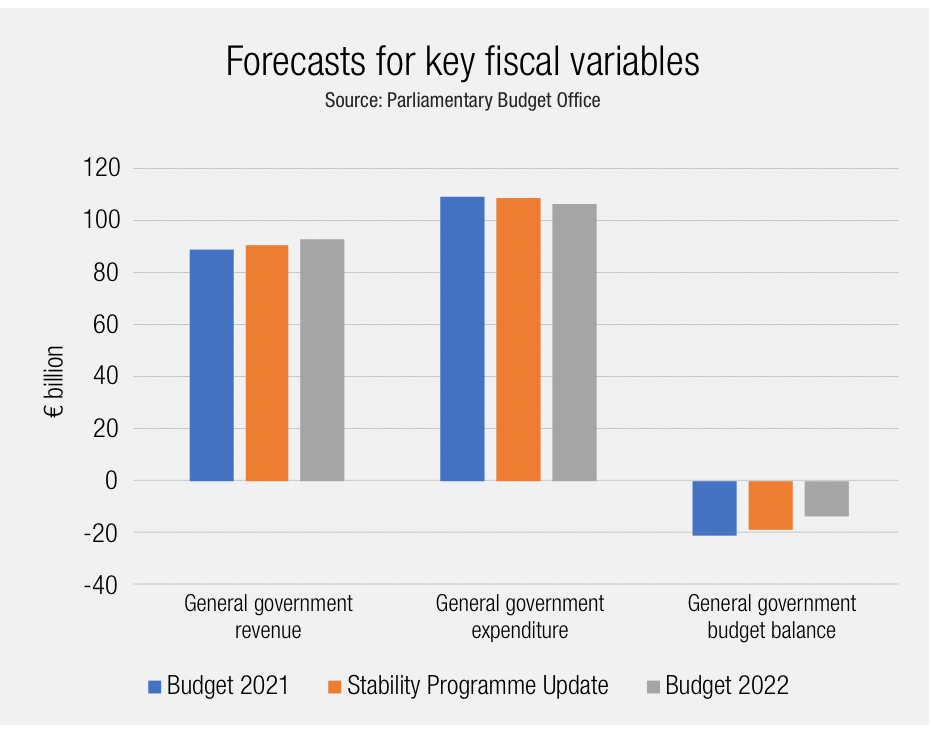

The PBO’s post-budget analysis notes: “Budget 2022 contains income raising measures of €340 million for 2022 and revenue reducing measures of €795 million for 2022. This will result in a net revenue loss of €455 million for the Irish Exchequer. The largest reduction in revenue was due to changes to personal income tax while the largest revenue gain was due to an increase in carbon taxes.”

Speaking during the ESRI’s post-budget analysis, research professor Kieran McQuinn noted that the State’s debt to GDP and debt to GNI* ratios are expected to return to 2019 levels in 2022, showing a quicker-than-anticipated recovery from the Covid downturn. McQuinn warned of risks such as inflationary pressures, specifically with regard to developments in energy markets meaning that inflation is expected to rise, and the coming issues with corporation tax. He also stressed that the capital investment to be committed in Ireland must prioritise projects which increase productive capacity such as housing and health.

His ESRI colleague, research officer Barra Roantree welcomed measures such as the Zoned Land Tax and the living alone increase, calling them “well targeted”; he did, however, criticise the changes to tax credits and bands, as well as social welfare, as “inconsistent”.