Can Corporate PPAs play a role in Ireland’s renewables revolution?

Dan Quinn, Head of Energy Markets at SSE Airtricity, looks at whether the time is now right to create a Corporate PPA market for renewables in Ireland.

With developers across the energy industry completing their preparations for the new integrated Single Electricity Market (I-SEM), attention is now turning to finding a route to market for the next phase of renewables projects. The pathway is becoming clearer. First through the opening of an application window for new grid connections under the regulator’s enduring connection policy (ECP-1), and then through the long-awaited publication of a high-level design for the Renewable Electricity Support Scheme (RESS).

These events have provided much-needed direction, as the industry sets out to help Ireland achieve its ambitious renewable energy targets to 2030, and beyond. The last opportunity for large renewables projects to apply for a grid connection, the ‘Group Processing Approach’ (GPA) or Gate 3 process, closed almost 10 years ago, so the opening of ‘ECP-1’, the first stage of the Commission for the Regulation of Utilities’ enduring connection policy in Ireland, is a major step forward for developers.

The other big milestone occurred in July this year, when the Irish Government published high-level details of the new Renewable Electricity Support Scheme (RESS), designed to support the development of renewable generation projects in Ireland. The scheme is a long-awaited replacement for the Renewable Energy Feed-In Tariff (REFIT), which closed for new applications in 2015.

The projects supported under the early RESS auctions will undoubtedly play a significant role in the growth of renewables in Ireland, lessening the impact of fines for missing our binding 2020 EU targets. However, with an aspirational RES-E (Renewable Energy Source for Electricity) target of 55 per cent by 2030, the RESS alone will not deliver the volume of generation needed to reach our more ambitious, longer-term goals. Therefore, we cannot solely rely on state support.

To bridge the gap, we will also need creative and innovative financing solutions. At SSE Airtricity, we’ve been busy exploring all the options open to developers, and we believe Corporate Power Purchase Agreements (PPAs) have the potential to play a significant role.

Typically, developers have preferred government-backed support schemes due to their stable and long-term nature, while Corporate PPAs have often been met with scepticism. This view has been founded in the context of challenges surrounding divergence in price expectations from the parties involved, duration and bankability of contracts, and the absence of comparable price data. Additionally, planning and grid access issues have seen a shortage of suitable, ‘shovel-ready’ projects. As a result, the Irish market is yet to see a subsidy-free Corporate PPA. However, the looming international climate and energy targets, and their associated penalties, mean that scepticism is quickly being replaced by curiosity.

So why do we believe a Corporate PPA market is achievable in Ireland, when other arguably more advanced and more competitive markets elsewhere in Europe, have seen limited success? Well, it’s all about supply and demand. Supply from a growing pipeline of fully-consented renewables projects, and demand for green energy from locally-based corporates. In relation to the former, historic barriers for renewables projects are starting to lift. A growing pipeline of consented projects, including wind and solar, are all looking for an effective route to market. As for demand, Ireland is home to more than 60 per cent of the RE100 signatories, a Climate Group initiative under which the world’s most influential companies commit to achieving 100 per cent renewable power by a target date.

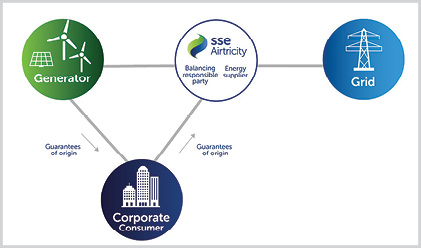

Corporates across Europe and the US have successfully met their green objectives through Corporate PPAs, typically using one of two ‘standard’ structures – ‘sleeved’ or ‘virtual/synthetic’ – although there are upwards of 26 variations used internationally. The market in Ireland has seen the emergence of an additional model, incorporating a ‘supplier-lite’ type structure. This requires the corporate establishing itself as an energy supplier, taking on all associated administrative and assurance burdens, to provide a clear link between their energy supply and the renewable generation they’re financially supporting. This is a complicated and costly process, and the same result can be achieved through the simpler, internationally-recognised ‘virtual/synthetic’ structure mentioned above.

Take for example a recent announcement by Facebook, where they have signed a 15-year PPA in Norway for the output of the 294MW Bjerkreim cluster of three wind farms. Under the terms of the deal, Facebook will buy 1,000GWh of electricity each year to power its data centres in Denmark and Sweden. While the projects are being developed by Norsk Vind Energi, and ultimately owned by German renewables investor and asset manager Luxcara GmbH, the Swedish state-owned utility Vattenfall AB will have the long-term supply and service agreements from Facebook. Vattenfall will integrate the wind energy into Facebook’s supply agreement and provide balancing services for the wind farms.

At SSE Airtricity, we believe this is the model best suited to the market in Ireland. Our Regulation and Public Affairs teams have been busy engaging with the relevant authorities on the market structure front, to allow Corporate PPAs of this kind to play their part in Ireland’s renewables revolution.

As the largest integrated renewable energy provider in the market, SSE Airtricity can bring together all the components required for successful transactions, including:

• large energy user customer base;

• large PPA portfolio;

• understanding of value contribution of all parties to Corporate PPA ecosystem;

• understanding of financiers’ requirements; and

• settlement capabilities.

It’s important to note that Corporate PPAs are not just for the tech giants of this world. Under EU Directive 2014/95, already transposed into Irish law, all corporates with more than 500 employees are required to disclose non-financial information including their greenhouse gas emissions and energy consumption. At SSE Airtricity, we are increasingly involved in discussions with a wide range of businesses who have a growing appetite for reducing their carbon footprint. A tailored contract aggregating these kinds of businesses could provide the load required for a Corporate PPA arrangement. Alternatively, a project of the right size could allow a medium size business to go it alone.

So, is it time for a Corporate PPA market in Ireland? The laws of supply and demand certainly seem to suggest the market is there. And we believe the solutions are too.

For further information:

E: EnergyMarkets@sseairtricity.com