Data centre sustainability

With the implications of Brexit appearing to further bolster Ireland’s attractiveness as a destination for data centres, questions have been raised about the country’s ability to match the renewable energy ambitions of centre operators.

One of the key factors in Ireland being a leading attraction for data centre operators lies in its advanced connectivity, both to Europe and to North America. A total of 14 undersea fibre cables, the latest being a new connection from Cork to France announced in early 2017, have been added to with the recent additions of two new cables connecting Ireland to the US, creating a total of four.

These connections have paved the way for global firms to invest heavily in Ireland but that investment has also posed some challenges to the country to ensure greater efficiency in terms of energy delivery.

At the launch of their first data centre in Ireland early last year, Facebook announced their facility in Clonee, County Meath, will operate on 100 per cent renewable wind energy. They stated that they had struck a partnership Brookfield Renewable, an operator of wind energy projects across Ireland, to provide the Single Electricity Market (SEM), with the same level of renewable energy required by Facebook to operate their new facility and to power their headquarters in Dublin.

Apple and Google, amongst others, also have major needs for renewable energy. While Ireland has made great strides in utilising its environment for increased levels of renewable energy creation, there remains a heavy dependency on fossil fuels, to the extent that there are now question marks over whether Ireland will be able to uphold EU targets set out for 2020.

These targets include 16 per cent of Ireland’s final energy consumption coming from renewable energy by 2020 and 40 per cent of electricity consumption by the same timeframe. While Ireland has made advancements in renewable production mostly from wind, there remains a general consensus that more needs to be done to avoid any potential monetary fines for not reaching EU targets.

Demand for a greater renewable energy source is likely to increase in correlation with the growth of Ireland as a data centre hub. Already on par with the likes of London, Amsterdam and Paris, the impact of Brexit and new EU regulations around data protection are set to only increase Ireland’s attractiveness to operators. As well as the big global hitters, co-location growth has been spurred on by the imminent legislation changes.

The General Data Protection Regulations (GDPR), which will be implemented from 2018, evolve around the protection and storage of citizen data. Tied with the recent ruling by the European Court of Justice that the European Commission’s trans-Atlantic data protection agreement was no longer valid, Ireland is likely to see an increase in US and UK data centres relocating to Europe, with Ireland a likely beneficiary.

It is hoped that the increased demand will act to spur on Ireland’s acceleration of renewable energy usage.

The National Offshore Wind Association of Ireland (NOW Ireland) recently suggested that Ireland is likely to miss its renewable energy targets for 2020 and in doing so face hefty fines and a potential ban on green energy exports.

NOW Ireland suggest that economic growth has resulted in rising energy needs but that those needs are not being supported by suitable onshore wind energy sites, which it suggests are dwindling.

Offshore wind energy generators would be main loser if any ban on exporting power to Europe was to be put in place and as a result NOW Ireland called on the Government to overhaul its policy in relation to offshore wind generation.

Secretary general Brian Britton says: “Successive governments have placed all their eggs in the basket of onshore wind. Other technologies, such as offshore wind, have been pushed towards the export route to market.

“If the Government’s narrow focus fails to deliver, Ireland will face significant fines and the offshore wind industry, which could deliver the entire renewable energy shortfall for Ireland, will be locked out of the export market as well as the home market.”

Data centre: evolution

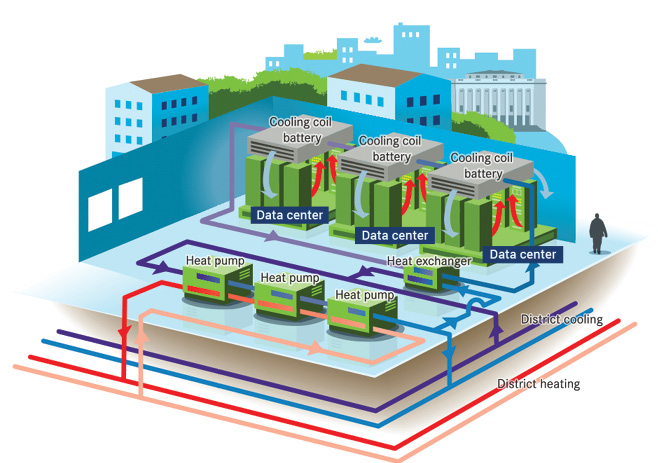

Data centres in Ireland have progressed a long way from the early conceptions which largely made use of existing buildings. Since then energy conservation has become much more of a focus and all most all new and existing centres have been custom built to handle the huge swell of energy. A major contributor to Ireland being seen as a more favourable location than other countries across Europe is it’s weather conditions and cooler climate, making it less costly to keep the technology at a cool enough temperature to operate than a country of warmer climate.A recent initiative arising from Stockholm in Sweden has put the onus on data centre operators to evolve even further and potentially utilise the excess energy created. The Stockholm initiative has seen excess heat from data centres redirected into a heatsink and distributed to homes via the city’s municipal heating system. It is estimated that a data centre with 10 MW capacity has the 20,000 residential apartments and the benefits are twofold, creating revenue for the data centre and climate benefits through reuse of CO2 intensive heat.

The cluster of Ireland’s data centres along shadowing the route of the M50, represents potential for Dublin to follow a similar scheme or at least be inspired to innovate further.