Economy growth better than forecast but expected to slow

The Economic and Social Research Institute (ESRI) is reporting higher growth for the Irish economy in 2019 than it had previously forecast, but growth is set begin to slow in 2020.

The economy is set to register a 6 per cent GDP increase in 2019, with the ESRI saying in their quarterly economic report for quarter three of 2019 that “certain multi-national related transactions are distorting the headline figures”. However, increasing tax receipts and the continuously strong performance of the labour market means that the foundations of the economy are also functioning well.

Persistent growth is deemed “remarkable” by the ESRI given the political turbulence of 2019 such as the Brexit negotiations and the slowing of the global economy. With the UK leaving the EU and trade negotiations set to be concluded by the end of the year, there will “almost certainly” be “further uncertainty” in 2020, leading the ESRI to predict that the growth rate will fall from 6 per cent to 3.3 per cent.

In their quarterly report for Q2 of 2019, ESRI had predicted an annual growth rate of 4.9 per cent for 2019, but their upward revision of the overall figure has come as a result of a strong Q3 performance by the exports sector. They predict that next year’s slowed growth will be the product of the “deteriorating external environment”.

Consumption, government expenditure, investment, exports, imports, GDP and GNP are all predicted to see growth in 2020, but all of these increases are expected to be reductions on the rate of growth. GNP growth is forecast to fall from 5.2 per cent to 3.8 per cent, with government expenditure to fall from 4.2 per cent growth to 3.6 per cent growth, although this prediction was made before the calling of February’s General Election. The most significant drop offs in growth rate are predicted to be investment (45 per cent to 4.7 per cent) and imports (20.2 per cent to 7.2 per cent). Exports are also predicted to fall from 9.6 per cent growth to 6.3 per cent after their strong showing bolstered the overall growth predictions.

Labour force

The unemployment rate stood at 4.9 per cent in November 2019 and is predicted by the ESRI to average out at 5 per cent for the year 2019. It is forecasted that this figure will fall to an average of 4.6 per cent for the year 2020. Employment increased by 2.3 per cent in 2019 and is predicted to increase again by 1.9 per cent in 2020, with overall labour force growth of 1.7 per cent in 2019 and predicted growth of 1.3 per cent in 2020.

Average weekly earnings rose by 3.4 per cent year-on-year for Q3 2019, with the ESRI forecasting an overall growth of 3.5 per cent for the year 2019 and 4 per cent growth in 2020. Real earnings were also predicted to grow in 2020, by 3 per cent.

Housing

The housing market is said to have been a large component of domestic growth, with the total volume of mortgage drawdowns up 8.5 per cent in Q3 2019 and the volume of drawdowns for first time buyers up 14.3 per cent in the same quarter.

In welcome news for buyers, national price growth is slowing while prices are dropping in Dublin. National prices slowed to 1.1 per cent growth for the year ending September 2019, while Dublin prices dropped by 1.3 per cent in the same period. Rents, however, have seen further rises, increasing by 7 per cent nationally and 7.1 per cent in Dublin year-on-year in Q2 2019.

Public finances

The ESRI is predicting a deficit budget in 2020, along with a further fall in the debt-to-GDP ratio, from 2019’s projected 57.8 per cent to 53.9 per cent.

Tax receipts have increased by 6.9 per cent for the period of January to November to 2019, with income tax receipts up by 8.5 per cent and the “particularly strong” revenue generated by corporation tax, which grew by 6 per cent in the same period. This growth in corporation tax represents a potential challenge for the new government as corporation tax has come to account for an increasingly large proportion of Irish tax receipts.

The Government was reported to have collected €6.9 billion in corporation tax by November 2019, a record at that point. Having experienced remarkable growth in the 2010s, corporation tax now counts for 18 per cent of total tax receipts and has more than doubled its level since 2014. ESRI research shows that corporation tax receipts rose by 148 per cent between 2012 and 2018, from €4.3 billion to €10.4 billion. The proportion of total tax receipts has also risen in that time, from 11.7 per cent to 18 per cent, making corporation tax the third largest source of tax revenue in the country.

There is concern, the ESRI say, that a portion of 2019’s corporation tax income comes from windfall revenues, which would make the level collected unsustainable. A sudden reduction in the amount collected would require “significant measures” in order to “maintain fiscal discipline”. The ESRI warns that it is important to build up “fiscal buffers” to absorb any external shocks, which are predicted to only become more frequent, and that it is also important not to use windfall amounts to fund government expenditure.

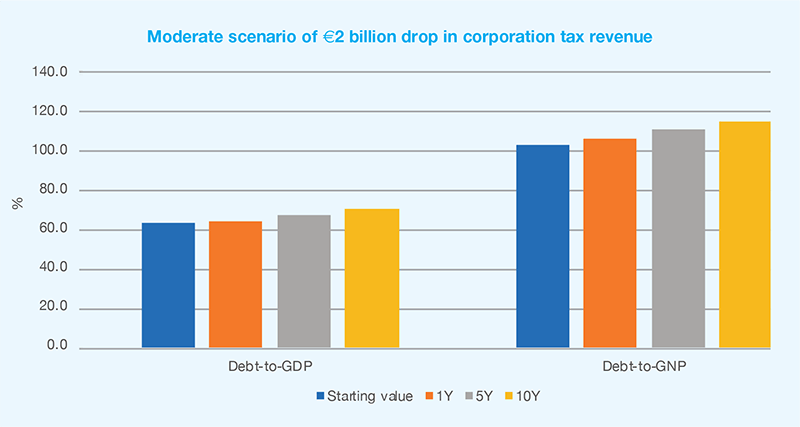

It is predicted that a €2 billion fall in corporation tax receipts would result in significant rises in many public finance indicators over 10 years. Debt-to-GDP would rise from 63.6 per cent in 2018 to 71 per cent; debt-to-GNP would rise from 104.3 per cent to 116 per cent; the 10-year Government Bonds rate would rise from 0.94 to 14; and the surplus-to-GDP rate would fall from 1 per cent to 0.6 per cent.

In the more drastic scenario of the corporation tax receipts falling by €6 billion and returning to early 2010s levels, debt-to-GDP would rise to 84 per cent within 10 years; debt-to-GNP to 138 per cent; 10-Year Government Bond rates would increase to 45 and the surplus-to-GDP rate would fall to -0.2 per cent.

The unreliability of corporation tax, specifically windfall revenue, as a source of income “highlight[s] the vulnerability of the Irish public finances to significant variations in these receipts”. The ESRI state that these results “reiterate the need for the Government to ensure that current expenditure is funded purely on the basis of sustainable elements of taxation revenues”.