FDI above pre-pandemic levels

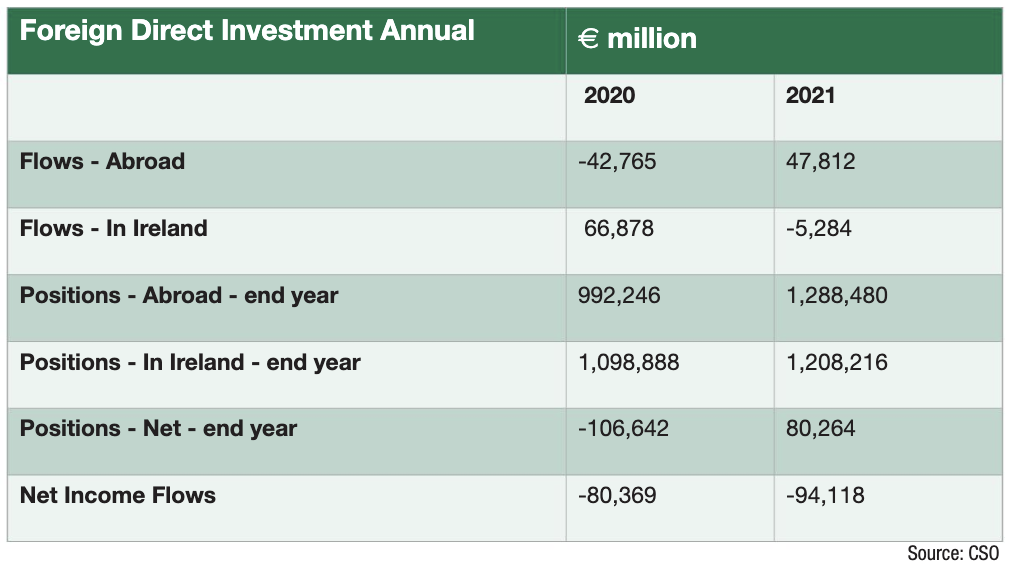

Foreign direct investment (FDI) saw a growth of €109 billion in 2021, according to a release from the Central Statistics Office (CSO), bringing it to a grand total of €1.2 trillion.

For comparison, the UK’s Office of National Statistics (ONS) states that FDI in the UK in 2021 was €2.3 trillion, meaning that the UK attracted slightly above twice as much as in Ireland, despite the UK having a GDP which is at least six times higher than the GDP of Ireland.

The report further states that investments abroad from Ireland increased by €296 billion in 2021, increasing the overall figure to €1.3 trillion, again above pre-pandemic levels.

Faris Bader, a statistician in the CSO’s international accounts division, stated: “The increase in foreign direct investment in Ireland of €109 billion to €1,208 billion is largely attributed to increased investment from the US, which was offset by decreased investment from other countries. This increase in investment is seen almost entirely in the services sector, predominantly in financial intermediation.

“Meanwhile, Irish foreign direct investment abroad increased by €296 billion to €1,288 billion, with investment in Europe increasing by €181 billion and investment in the US increasing by €77 billion. This increase is also seen almost entirely in the services sector, mainly with Europe.”

The report states that the services sector was the largest for inward investment, accounting for €736 billion – 61 per cent of the total investment figure.

Inward investment

With an overall level of FDI of €1.2 billion, Ireland is punching above its weight in terms of attracting foreign investment, with the result of 25 per cent of the labour force in the State working for foreign companies.

This is partially due to what the European Parliament in 2019 referred to as the “tax haven” status of the Irish economy, with a corporation tax which is almost half the EU average, and significantly less than that of the UK.

Additionally, companies, most notably Apple and Google, have been able to avail of the ‘double Irish’ method, resulting in the European Union ordering Apple to pay €13 billion in 2016 to the Irish exchequer in unpaid taxes, a move opposed by the Irish Government.

In 2021, the United States was significantly ahead of other states in providing investment into Ireland, with investments totalling a little over €423 billion.

Other significant sources of investment came from Luxembourg (€132 billion), the Netherlands (€123 billion), Switzerland (€92 billion), the Cayman Islands (€55 billion), the UK (€33.3 billion), France (€26.5 billion), Japan (€21 billion), and China (€9.1 billion).

The report does not disclose the purposes of the investments by source, meaning that whilst the overall sectoral investment has been stated, that there is no breakdown of sectoral investment by the nation from which the investment originates.

Outward investment

Investment abroad from the State increased by almost 25 per cent in 2021, rising by €296 billion from the 2020 figure to a total of just under €1.3 trillion, again above pre-pandemic levels. The precise sources of these funds are not disclosed by the CSO.

The largest destination for investment from Irish-sourced money is Luxembourg, with investments from Ireland into the Grand Duchy amounting to €494 billion. This is followed by the second highest destination, the United States, with €282 billion of Irish money making its way stateside.

The figures reveal a level of investment between the UK and Ireland which is skewed in that the UK received around €101 billion in FDI from the State, around 66 per cent higher than the investment into Ireland from the UK.

Other notably large markets for investment from Ireland include the Netherlands (€87 billion), the Isle of Man (€79 billion), France (€8.6 billion), Australia (€3.8 billion) Japan (€3.7 billion), and an increasing level of investment into Mozambique (€776 million).