Housing trends

House prices have not yet reached a trough and there won’t be a major upturn in the housing market until economic growth becomes sustained, writes the ESRI’s David Duffy.

House prices have not yet reached a trough and there won’t be a major upturn in the housing market until economic growth becomes sustained, writes the ESRI’s David Duffy.

Although a number of other countries experienced housing booms at the same time as Ireland, the extent of the fall in Irish house prices has been more severe than that experienced elsewhere.

There are a number of different house price measures for the Irish market which, having peaked in late 2006 or early 2007, show that house prices are now at least 30 per cent from peak, with some measures showing declines of over 48 per cent.

When thinking about the outlook for the housing market, the role of the macro- economy is important as an important contributor to demand is the state of the economy. Over the period 1995-2006, it is estimated that real GDP doubled. As the economy grew, personal incomes increased substantially as well as the number of people in employment.

The economic drivers of the housing market have been negative in recent years and although some of these may improve in the short term, any improvement is likely to be small and from a much lower base.

The economy is expected to return to growth in 2011, although the projected rate of growth is modest. The recession has seen falls in disposable incomes reflecting wage cuts and higher taxes. The unemployment rate has risen substantially and looks likely to remain at a high level for the next couple of years at least. In addition, households must deal with the high levels of personal debt in the economy. The economic boom was accompanied by a large increase in personal debt levels, with much of the increase being driven by mortgage borrowing. The priority being attached to reducing debt levels will take money away from the housing market in the short term.

The housing market also benefited from strong inflows of people into the country as economic growth meant Ireland was perceived as a place of opportunity. This created demand for houses to own and rent. Unfortunately the downturn has seen the return of emigration. In the year to April 2010, 34,500 emigrated and the ESRI is expecting that the net outflow will be approximately 60,000 in the year to April 2011 and 40,000 in the subsequent 12 months.

Affordability

The housing market downturn has had the positive effect of results in improved affordability as the fall in house prices has been much sharper than the falls experienced in income. This, coupled with low interest rates, has meant an improvement in affordability. The latest DKM/EBS Affordability Index shows that the amount of disposable income required to service a mortgage is now at the lowest level for the past twenty-five years and is similar to levels seen in early 1988 and early 1995.

Entry to the European Economic and Monetary Union resulted in a sharp decrease in Irish interest rates and the move of interest rate decision making to the European Central Bank (ECB). Recovery in Europe means that official interest rates seem set to increase. However, the credit crunch may have resulted in a structural change with regard to interest rates. The cost of funds has risen and remains higher than ECB rates. There has been a move by financial institutions away from mortgage products tied to the ECB rate. Mortgage lenders have raised interest rates independently of changes by the ECB. Thus, we are likely to see higher borrowing costs for the foreseeable future than might otherwise have been the case.

A factor that may become more important in the current financial market environment is the availability of credit and mortgages to individuals and households. Lower lending volumes in the face of funding constraints for banks will have a negative impact on housing demand. At the same time, recent Irish Central Bank lending surveys show the demand for loans from households for house purchases decreased during the final quarter of 2010, reflecting less favourable housing market prospects, reduced levels of consumer confidence, and increased savings by households.

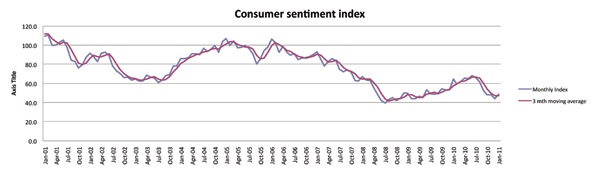

In assessing the outlook for housing demand and house prices it is evident that housing market indicators show a mixed picture. Improvements in affordability are offset by a weak economy, high unemployment and lower incomes. It seems unlikely that there will be a major upturn in the housing market until economic growth becomes sustained and reduces the unemployment rate. The global downturn has contributed to a sharp decline in consumer sentiment. The index remains close to its 12-year low and reflects the uncertainty and cautiousness of consumers at present. Worries about the outlook for the economy and the labour market, coupled with concerns about household finances have all contributed to the decline in consumer sentiment. These factors have contributed to the loss of consumer confidence but also help to explain why consumers have stayed away from the housing market in recent times. Buying a house represents a major long- term financial commitment. Uncertainty about the outlook for your job or income means you will be much more cautious before committing to such a purchase. Furthermore, although house prices have fallen there is the feeling that they have not yet reached a trough and so the expectation is for further price decreases.

Indeed, when the demand for housing does start to pick up again the impact on the housing market may take some time to feed through. A consequence of the current slowdown is that there is now a large overhang of unsold property, with the vacancy rate estimated at over 16 per cent of the housing stock. This compares with a vacancy rate of around 6.5 per cent during the late 1990s. While some of these vacant properties will be holiday homes, the increase in vacant houses in recent times indicates that there is a large overhang of properties that are waiting to be sold, estimated at between 100,000 and 120,000 properties.

Another factor that could influence the speed of any recovery is the presence of negative equity. It is estimated that around 300,000 borrowers are in negative equity as a result of the price declines and high loan-to-value ratios. Those in negative equity may decide to wait until house prices recover sufficiently to repay their outstanding mortgage. Any recovery in transaction levels is therefore likely to lag recovery in prices.

The performance of the housing sector is very important for the economy going forward. Given the expectation that house prices would fall by approximately 50 per cent from peak to trough, the different house price measures suggest that the bulk of the adjustment has already taken place. At the moment it seems likely that most of the factors influencing Irish housing demand will show some stabilization, although remaining weak, over the next two years.

Although we have already experienced a number of years decline, unfortunately it seems likely that house prices will continue to fall in 2011, before stabilising in 2012.