Ireland’s data centres

eolas looks at the evolution of and the factors behind Ireland’s rise to becoming one of Europe’s leading hubs for data centres.

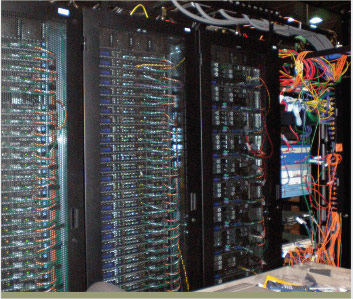

Space to grow the Irish economy following in the wake of the downturn has been data driven. Massive internet players such as Microsoft, Google, Facebook and Amazon have all recognised Ireland as a prime location for investment, meaning that methods of economic growth have changed. Since 2008, it is estimated that more than $4 billion of capital investment has been spent on data centres in Ireland, most of which are clustered in Dublin, and that number is expected to rise as Ireland is increasingly recognised as the data centre capital of Europe. Currently Ireland hosts a fairly even split between ‘co-location’ facilities, servers developed and operated by specialists to host data for a third party, and ‘hyper scale’ facilities developed by cloud computing companies like Google and Amazon for storage and exportation of data on their own products.

The main reasons as to why Ireland is seen as a significant location include:

Weather

The average temperature of Ireland’s hottest month, July, sits at 16°C and is significantly cooler than even the coastal regions of warmer climates such as the US. The country’s temperate climate and relatively stable weather conditions means that it offers natural cooling to large servers producing huge volumes of heat.

Space

As well as having a significantly lower real estate cost when compared to somewhere like London, Ireland has also been highlighted as a less densely populated region. While many of the data centres have chosen to locate in Dublin, the mobility of the work associated with data centre technology offers companies an option to locate staff less centrally. One example of this is Hewlett Packard’s large data centre in Dublin which sustains 220 jobs located in Galway.

Connectivity

Ireland has been largely recognised as Europe’s closest connecting point to the US thanks to its position as a landing spot for transatlantic cables connecting Europe to North America. Last year, for the first time in 12 years, Ireland received the deployment of two transatlantic cables connecting Europe, the Middle East and Africa. It is estimated that 95 per cent of the data held in Irish facilities is being exported to Europe, the Middle East and North Africa and being the closest point of communications to the US, there are latency and bandwidth advantages. The T-50 fibre trunking system, a 44km, 12-way metropolitan system around Dublin linking all of the major Business Parks and tying into the transatlantic cable system hubs has largely shaped the clustering of data centres along the M50 motorway, as it mirrors the T50 route. The clustering of approximately 250,000sq m of data centres in the area has proven beneficial in attracting new business to follow suit and has also raised Ireland’s profile as an attractive location for US companies wanting to sample the European market before expanding eastwards.

Skills

The development of data centres has created short-term injection of employment in the economy’s construction sector. While some criticism has been levelled at level of full-time employment jobs sustained once the data centre is operational, other have pointed to the value of the jobs in attracting high quality data scientists, analysts, engineers and software developers. A talent pool of English-speaking, IT graduates (in 2014 the Higher Education Authority estimated that 43,164 students completed an undergraduate or a postgraduate degree in science, mathematics and computing) has also been attractive, and could potentially be advanced when Ireland becomes the largest English-speaking EU member state post Britain’s withdrawal.

Power

Considering the volume of power consumed by operating a data centre, accessibility to power and the source from which it is being generated has been an crucial factor in location sourcing. Over capacity on Great Britain’s national grid and access to 100 per cent renewable power in Ireland has attracted international investment. Host in Ireland estimate that 23.7 per cent on Ireland’s energy is produced using green sources, (19 per cent from wind) and the Government has set a target of 40 per cent by 2020. Square footage and energy usage is crucial to a data centre’s standard, which is important to potential clients.

However, it has been recognised that in order for Ireland to meet the growing need of data centres significant infrastructure investment is required. EirGrid estimates that existing and planned data centres account for around 550MW but facilitation of further enquires would need a further 1,000 MW from 2019. If built, all these centres running at peak capacity would account for 20 per cent of Ireland’s power supply, a huge private demand on a national utility.

Tax rate

A major tool for Ireland attracting investment is that it boasts the lowest corporation tax in Europe at 12.5 per cent. This compares favourably to other countries such as the UK which is 20 per cent, Germany 30 per cent and the USA at 35 per cent. As well as a favourable tax rate, Ireland’s government also offers support to enterprises establishing operations in Ireland. Ireland’s Industrial Development Authority (IDA) supports companies financially and administratively for companies setting up in Ireland and through operation.

Data privacy

As conversations continue on data privacy and data protection issues surrounding international data transfers. Ireland currently boasts 100 per cent EU Data Protection compliant legislation. The Irish Data Protection Act is seen as pro-business and the politically stable environment is appealing both currently and going forward.