Irish SMEs win out against international retailers in online shopping battle

The .IE Tipping Point Report: How e-commerce can reignite Ireland’s post-Covid-19 economy, assessed the attitudes and responses to the Covid-19 crisis of Irish consumers and SMEs, writes David Curtin, CEO of .IE, the company that manages .ie domains, the preferred online identity for business in Ireland.

The Covid-19 crisis has been incredibly challenging for Ireland for many reasons. As a nation, we have endured months of isolation and a suspension of the natural order of things. Many of us have lost loved ones. Thousands of businesses have closed, unemployment has soared, and uncertainty prevails.

However, one Covid-19-induced tipping point has more positive long-term ramifications for Ireland and its economy. SME’s good intentions turned to urgent action to get online immediately. The aspiration to sell online went from ‘someday’ to become ‘today’. The impossible became a reality, with professional services firms consulting online, restaurants taking online orders, pivoting to click and collect, SMEs transforming rapidly, because they had to, in order to salvage their business during a lockdown. The consumer trend of shopping online for ‘midweek convenience’ and shopping in-store for ‘weekend experience’ was interrupted. The insights and key findings from the .IE research are presented below.

Insights

By consolidating the new learnings from the .IE Tipping Point Report with the findings of other Covid-19 related surveys, we have developed insights that show how the digital and e-commerce landscape in Ireland is changing:

Solidarity and support for local business

Solidarity and support for Irish businesses may never be stronger. To turn the positive sentiment into sales, Irish businesses must dial up their online competitive advantages of trust, reliability, and solidarity when their websites are competing with online international sellers. Our research shows that Irish consumers perceive that local SMEs lag on price and product range.

Covid-19 as the catalyst

We are moving from a face-to-face, person-to-person economy to a delivery economy. Covid-19 has been the catalyst, accelerating changes and trends already in motion. The Covid-19 experience has changed consumers’ shopping habits for good. Those businesses thinking that this is a temporary blip are mistaken. Some SMEs are responding, getting online used to be a very slow process, now it’s only taking weeks.

Government finance for SMEs can act as an accelerant

Government financing is now available on a massive scale to help SME recovery. Representative organisations, having secured the funding, now need to advocate to ensure that SME projects include digitalisation and initiatives to modernise and digitise SMEs’ sales processes. Digital tools can improve SMEs’ productivity and competitiveness. Digital marketing can boost sales and cashflow.

Digital investment by SMEs pays off

In a difficult lockdown period for many SMEs, those that have invested in their digital and online presence have reaped the rewards at a time when other businesses are struggling. Although it’s easy for some SMEs, most SMEs who invested said they needed some assistance with selection and installation of digital tools.

The ongoing legacy of the pandemic

Work from home, shop from home, entertain at home: city centres are hollowed-out as fewer workers commute on public transport. This will represent an opportunity for towns to reinvigorate themselves. Secondly, professional services can be sold and delivered online too, despite previous disbelief. Covid-19 has broken the mould and proven that medical consultations, gym classes, and legal appointments can all be done successfully over online platforms, such as Zoom and Teams.

In the .IE Tipping Point Report, we have recorded a swing in online retail sales to Irish SMEs, away from their historically dominant international competitors. This is a significant milestone. The Covid-19 crisis has encouraged consumers to look closer to home for goods and services. While perceptions of quality and trust have played important roles in this, a major proportion of the consumers we spoke to said that they simply wanted to support Irish businesses through a challenging period.

Irish consumers are spending more online with Irish SMEs that have pivoted to help save their businesses during the lockdowns. We need to press the advantage and ensure this is not short-lived. So far, the signs are good for this omni-channel approach.

Acknowledging the significant allocation of government funding secured by business groups for the recovery of Ireland’s SME sectors, it is important to ensure that finance is dedicated to investment in digital tools and digital skills for SMEs. Properly equipped to meet consumer demand, small businesses can play a major role in reigniting Ireland’s post-Covid-19 economy.

Key findings

E-commerce before Covid-19

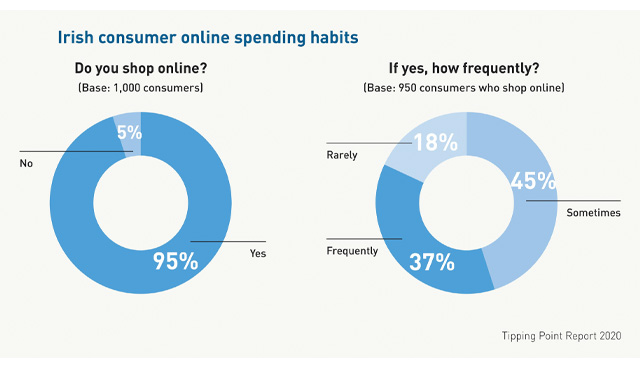

E-commerce is worth a great deal to the Irish economy. Irish consumers are eager to spend on the internet: 95 per cent of our survey respondents say that they shop online, 82 per cent either frequently or at least some of the time. The cohort that does all its shopping offline is now part of a shrinking minority.

Even though online spending is the norm among Irish consumers, our research shows that just 25 per cent of SMEs sell online, which implies that the other three-quarters rely entirely on physical, in-person sales.

The consumer response to Covid-19

Despite most main street shops and office spaces being closed for business during lockdown, consumer demand online has continued unabated. 72 per cent of consumers have either spent more online during the Covid-19 crisis or the same amount as before.

Over two-thirds (67 per cent) of consumers who had done most of their online shopping with Irish businesses explicitly stated that they wanted to show solidarity and “help Irish SMEs through the crisis”. Other factors have played an important role. Online Irish businesses are seen as faster and more reliable than international businesses, and more trustworthy.

The SME response to Covid-19

21 per cent of SMEs have invested in their online presence since the Covid-19 crisis began. Investing in online creates more ways to generate sales and connect with customers. 46 per cent of SMEs that have invested in online services during the Covid-19 crisis are busier than or as busy as before.

Among the quarter of SMEs that have online sales capability, 88 per cent have noticed a change in their volume of sales since the Covid-19 crisis began; 77 per cent say this has been a positive change. Of that number, over a third (37 per cent) have noted an increase of more than 25 per cent.

E-commerce post-Covid-19

Social distancing, queues, and capacity limits are here to stay, until Covid-19 is controlled. Consumers are aware of this, and online shopping offers them a way to avoid inconvenience and crowds. 74 per cent say that current restrictions will impact their decision to shop in physical stores to some degree. It is clear that a ‘blended’ shopping approach is preferred by consumers.

E: marketing@weare.ie

W: www.weare.ie

Research for .IE was conducted in 2020 by Core Research with 1,000 Irish consumers and 500 retail and customer-facing professional services SMEs.

The .IE Tipping Point Report was prepared in partnership with Digital Business Ireland.