A divergence in economic growth forecasts highlights economic uncertainty driven by Ireland’s reliance on multinational investment, writes Joshua Murray.

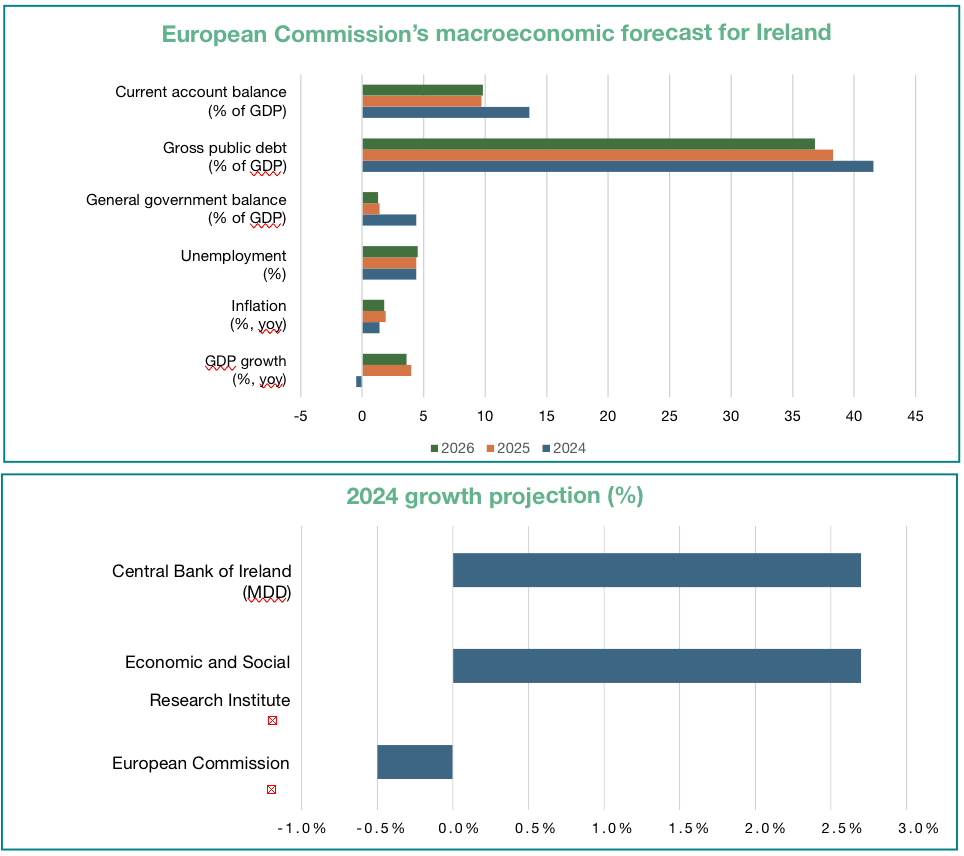

Different bodies have made divergent projections for economic growth in Ireland, ranging from the European Commission’s projection of a technical recession, to steady growth forecasts outlined by the Economic and Social Research Institute (ESRI) and the Central Bank of Ireland.

The European Commission’s Autumn 2024 Economic Forecast anticipates a GDP contraction of 0.5 per cent in 2024, followed by robust recovery in 2025 (4.0 per cent). The negative outlook for 2024 is attributed to a steep downturn in the State’s multinational sectors, particularly ICT and pharmaceuticals, which are heavily exposed to global market demand.

The Economic and Social Research Institute (ESRI), however, projects a more optimistic scenario for underlying economic activity, with modified domestic demand (MDD) expected to grow by 2.7 per cent in 2024, driven by consumer spending, government investment, and robust employment levels. The ESRI’s approach to growth projections emphasise domestic demand, which it argues is insulated from multinational sector volatility to some extent.

The Central Bank’s forecast aligns closely with that of the ESRI, projecting modest but steady growth in MDD and anticipating inflation to stabilise at approximately 3.0 per cent, slightly higher than the Commission’s estimates. Their outlook is premised on strong labour market fundamentals and easing inflation pressures, which are expected to support household consumption.

GDP vs MDD

The GDP metric includes the contributions of multinationals, which dominate Ireland’s export sectors. Given the expected global downturn in the ICT and pharmaceutical sectors, the Commission’s forecast is more negative. MDD, on the other hand, isolates domestic economic drivers, leading ESRI and the Central Bank to project more robust growth.

Variations in inflation assumptions impact disposable incomes and consumption forecasts. The Commission projects subdued inflation, while domestic bodies account for stronger wage growth keeping consumption buoyant.

Multinational corporations account for a disproportionate share of Ireland’s GDP, but their activities often have limited spillover effects on the domestic economy. This difference creates divergence between projections that emphasise MDD versus GDP.

The European Commission incorporates broader European and global economic risks, such as potential recessions in the UK and eurozone, leading to a more cautious forecast. However, the ESRI is more optimistic about Ireland’s ability to decouple from these risks due to strong public finances and resilient consumption.

While both GDP and MDD-based projections provide valuable insights, MDD offers a more reliable measure of the economic activity that directly impacts Irish households and domestic businesses.

Insulating multinational volatility

Strong labour market conditions, with unemployment at a low 4.4 per cent, and continued wage growth suggest sustained household spending power, bolstering ESRI and Central Bank projections.

Ireland’s strong fiscal position enables counter-cyclical investments in infrastructure and social supports, which will cushion against external shocks and support domestic demand.

However, it is important to consider downside risks emphasised by the European Commission. For instance, if multinational downturns deepen with the new presidential administration in the United States, spillover effects on employment and tax revenues could indirectly impact domestic demand.

Furthermore, rising geopolitical tensions and possible recessions among key trading partners (such as the UK and the Eurozone) could challenge even optimistic domestic scenarios.

Ireland’s Bounty

In December 2024, the Irish Fiscal Council Advisory highlighted a strong economy, with record employment and robust corporation tax revenues driving budget surpluses. However, it echoes concerns expressed by other groups about risks tied to over-reliance on these volatile tax windfalls, which are concentrated among a narrow base of several multinationals. Inflation pressures persist, and spending plans are deemed overly optimistic, risking future deficits.

The Council urges the Government to adopt stricter fiscal rules, save more from windfalls, and improve transparency in forecasts. These measures, it states, are vital for addressing challenges in health, housing, and climate, while ensuring long-term stability and protecting jobs during potential downturns.

Analysis

The divergence in projections for Ireland’s economic growth in 2024 underscores the importance of contextualising metrics. While the European Commission’s cautious stance reflects risks tied to Ireland’s open economy and multinational dependencies, the optimism of ESRI and the Central Bank is grounded in the resilience of domestic demand and the labour market.

For decision-makers, projections emphasising MDD growth of 2.7 per cent in 2024 are arguably more reflective of the realities influencing households and businesses. However, when it comes to revenue raising, the GDP figure is of more interest, as a lower GDP figure correlates to lower corporation tax revenue, on which the State is reliant.

However, the differentiation in projections highlights the instability of Ireland’s economic model, and points to future challenges, especially if the new administration in the United States is to impose tariffs as it has promised to do, meaning that many of the multinationals forming the backbone of the Irish economy, may be forced to restructure if they are to continue business in the United States.