OECD/G20 BEPS update

A March 2022 Parliamentary Budget Office (PBO) publication examines the OECD/G20 BEPS project, Corporation Tax revenue, and the potential impact on the Irish economy.

Annually, the OECD estimates corporation tax losses range from $100 billion to $240 billion, or the equivalent of between 4 and 10 per cent of international corporation tax revenue.

An upsurge in digital services, allied to the tax avoidance practices of multinational companies combined to provoke the OECD into limiting international tax competition and protect tax bases. As such, the OECD BEPS project is the most significant attempt to change the international tax landscape in a century.

Incorporating a dual strategy for transforming the international corporation tax landscape, Pillar One aims to amend profit allocation rules, while Pillar Two seeks to implement a global minimum level of corporation tax of 15 per cent within each jurisdiction that multinational companies operate by 2023.

The global minimum corporation tax rate applies to multinationals with revenue above €750 million. As a result, it is anticipated that countries will increase annual corporation tax revenues by $150 billion.

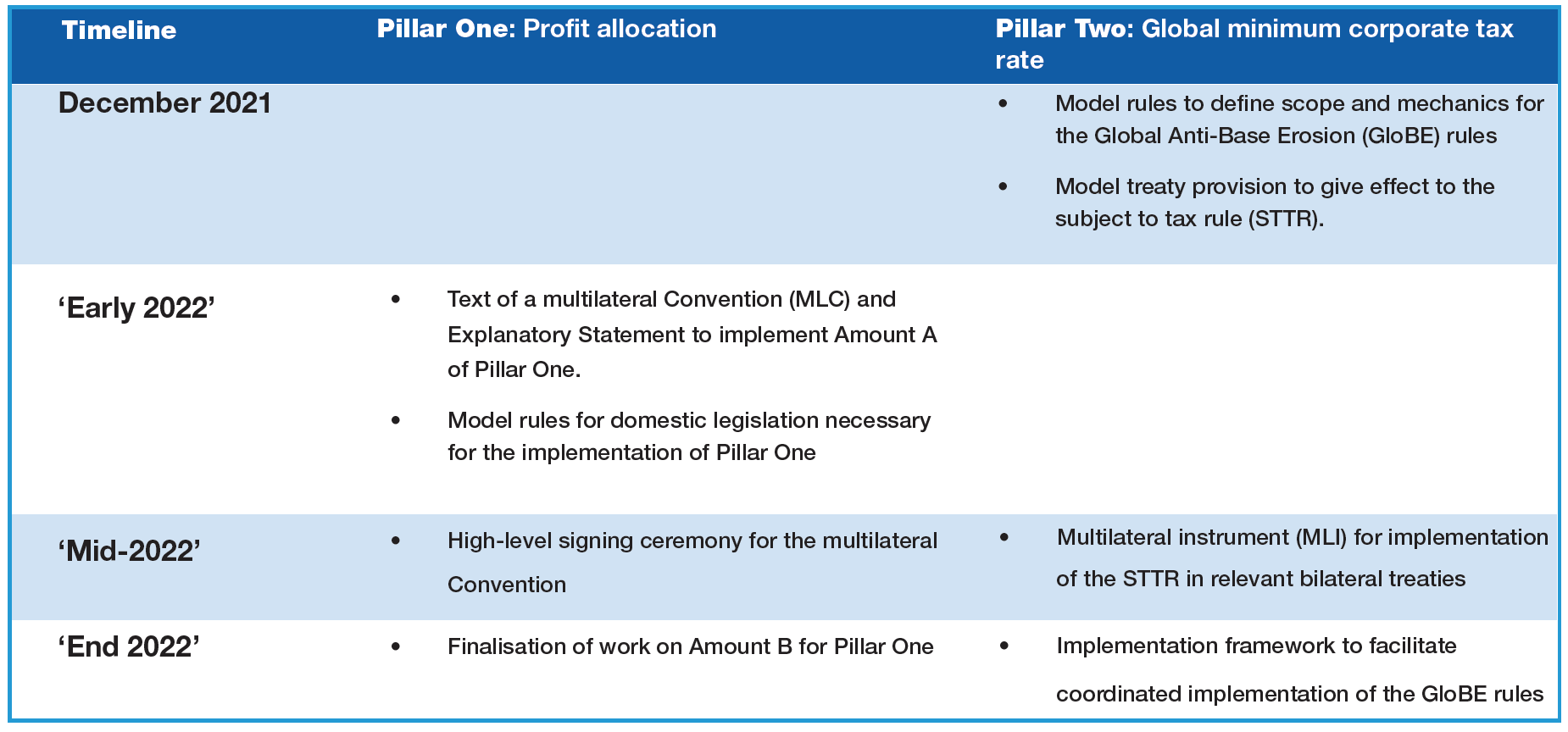

Timetable

As per Table 1, the OECD BEPS process is set to be implemented from the start of 2023. However, the PBO highlights that, “the timetable is very ambitious for such a significant change to international taxation,” and that comparable changes have required an average of two years for countries to implement.

MLC

Meanwhile, Pillar One will be agreed via a multilateral convention (MLC) expected to be signed in summer 2022. The MLC is intended to facilitate the swift and coherent implementation of Pillar One by OECD/G20 Inclusive Framework countries, ensuring that the countries do not require an existing tax treaty between them. Overall, the MLC will: outline rules for profit allocation; eliminate double taxation; outline the mechanism for dispute prevention and resolution; and require member jurisdictions to remove digital services taxes, committing not to introduce measures in the future.

EU

Alongside the other EU member states (excluding Cyprus), Ireland has signed up to the OECD BEPS Statement, Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy. In 2021, a total of 141 OECD member jurisdictions (94 per cent of global GDP) of the OECD/G20 Inclusive Framework on BEPS agreed to the statement, as well as a detailed implementation strategy.

Now, the European Commission is planning to adopt a directive that will implement Pillar Two within the EU. Mirroring the OECD BEPS agreement, the directive will outline how Pillar Two would be implemented in the EU, including a uniform set of rules on the calculation of the effective corporation tax rate across member states.

However, the directive will diverge from OECD BEPS in that the scope of its corporation tax rules will apply to domestic companies, while OECD BEPS will apply to foreign subsidiaries of multinationals. This will prevent discrimination between domestic and multinational groups to uphold the EU’s fundamental freedoms.

Alongside debate in the European Parliament and consultation with the European Economic and Social Committee, implementation of the proposed directive hinges on unanimous agreement between all member states in the EU council.

Ireland

In October 2021, the Irish Government signed up to the OECD’s Base Erosion and Profit Shifting (BEPS) project. In the PBO’s assessment, there is potential for the OECD BEPS project to have “a very significant impact, including a detrimental impact”.

In recent decades, Ireland’s economic model has been contingent on competitive tax policy (a relatively low rate of 12.5 per cent), aimed at attracting FDI. As such, corporation tax receipts increased from €3.9 billion in 2009 to over €15 billion in 2021 (22 per cent of exchequer tax receipts).

Shielding Ireland from fiscal shocks and poor planning, which have led to consistent spending overruns and increased permanent spending, unanticipated growth in corporation tax receipts have enabled increased expenditure, particularly in healthcare, without resorting to increased borrowing, taxation or spending cuts elsewhere.

Regardless, corporation tax is an unreliable source of funding for permanent expenditure. Owing to its volatility, narrow base, and vulnerability to shock, overreliance on this revenue stream has been consistently criticised by domestic fiscal institutions, including the Central Bank if Ireland and the Irish Fiscal Advisory Council.

For instance, one potential scenario identified by the Central Bank considers that reduced corporate tax revenue between 2021 and 2025 (as a result of OECD BEPS, for example), alongside an external shock (similar to the Covid-19 pandemic) could threaten Ireland’s public finances and debt sustainability.

Therefore, it is difficult to predict the impact that OECD BEPS will have on future corporation tax revenue. Indeed, it is possible that Pillar Two could have a positive effect on corporation tax revenue in Ireland. Any forecast is dependent on “multiple dynamic impacts on a diverse range of sectors” simultaneously in domestic, European, and global contexts.

Implementation of OECD BEPS is likely to radically alter the investment strategies and tax planning of multinationals. Globally, reduced tax competitiveness may result in a relegation of corporate tax factors in decision-making, versus other factors of economic competitiveness, including human capital and infrastructure. This could expose weaknesses, including capital infrastructure gaps, in Ireland.

That being said, even prior to Brexit, Ireland was regarded as a gateway to the European market for US multinationals. Factors which may mitigate against a detrimental impact of an increase in the effective rate to 15 per cent include Ireland’s status as a common law, English-speaking country with eurozone and EU membership.

Implementation of the OECD BEPS two-pillar solution, 2023