Oil and gas exploration outlook

Assistant Secretary for Natural Resources and Waste Policy at the Department of Communications, Climate Action and Environment, Matt Collins discusses the outlook for oil and natural gas development in Ireland.

Collins points out that this work must be undertaken against the backdrop of Ireland’s commitment to reduce non ETS emissions to 30 per cent of 2005 levels by 2030. By this stage the country will also be generating 70 per cent of its electricity from renewables and be committed to a net zero-carbon emissions target by 2050.

While referring to Ireland’s 2015 White Paper on energy transition, Collins says that the process will require a mix of solutions and resources being brought to bear and that it must also ensure that energy remains a reliable resource for consumers. Moreover, prices must be affordable and transparent.

Collins discusses the recommendations for natural gas development by Ireland, contained with the 2019 International Energy Agency Review. He says that within this scenario Ireland should act to ensure a stable and streamlined regulatory framework, and conduct regular licensing rounds, to encourage exploration activities and, subsequently, develop domestic reserves.

It must also optimise the role of gas in the transition to a low carbon energy system, including encouraging, through appropriate regulation and policy, the development of an LNG import facility and seasonal gas storage. A cost benefit analysis should be used when deciding on any public infrastructure investments and developing programmes for gas demand in the heating and transport sectors, Collins states.

In addition, Ireland should commit to introduce and promote — through a robust support scheme — the production of biomethane as an indigenous and sustainable form of gas that will contribute to the security of supply and sustainability targets. According to Collins, demand for gas in Ireland is currently out stripping supply. He adds that this scenario remains the underlying trend, whatever demand factors are included in the equation.

Collins says that Ireland ranked fourth among the EU’s 28 member states in 2015 in terms of its relative dependency on imported fuel sources, but by the following year, Ireland had fallen to tenth in the pecking order. “This reflected the impact of the Corrib Field,” he says. “Despite this change, Ireland still remained above the EU average in terms of dependency on imported fuels.”

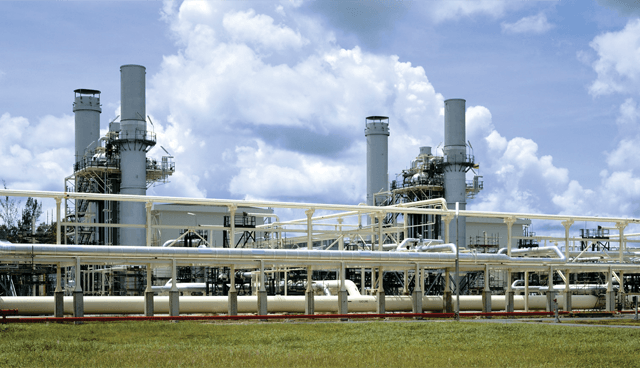

He explains that Ireland’s offshore licensing area for natural gas and oil is 10 times the size of the country itself. It is split into two regions: the Celtic Sea to the south and the Atlantic region to the west. In terms of exploration potential, the Celtic region is open for applications at the present time — the Atlantic is not.

Collins confirms that a number of exploration licenses have been made available by the Irish Government. All have been developed to ensure that they encourage efficient exploration with a clear focus on work programmes, in tandem with technical and operational efficiency, he says. “The number of exploration licences issued is at the highest level since exploration began in the Irish offshore in the 1970s,” he adds.

According to Collins, the Irish offshore has seen extensive acquisition of long offset high quality seismic data — both regional 2D and large 3D surveys — since 2011. “We need to further extend our seismic operations. A lot of new discovery work will hinge on the re-evaluation of older seismic data,” he says.

Where oil well exploration is concerned, Collins confirms that the Porcupine region is now a significant licensing area: “Ireland has a relatively low number of exploration wells, especially in recent years.

“We have moved out of the option phase with many licences, but we would expect to see further exploration wells to be developed over the coming years. The Porcupine space remains a relatively unexplored and developed resource.”

He explains that most of the exploration work over recent years has taken place in the shallow areas around Ireland’s coastline. It is to be expected that deeper exploration work will now start to gather momentum.

“A new well has been initiated this year in the Southern Porcupine area,” he says. “This may be significant moving forward. Ireland remains relatively unknown in the sector and this explains the amount of interest in exploration within Irish waters at the present time.”

Where gas is concerned, Collins points out that Corrib Field has been operating since 2015. In the case of the Kinsale Gas Filed complex, production has been ongoing for over four decades. Significantly, oil has not been discovered at either site. “Corrib has played a major role in improving Ireland’s energy security, but it is only one field, which is now in the decline,” he states.

According to Collins a lot of support is now available to facilitate research work carried out by oil exploration companies and Irish academics. He cites the examples of the Petroleum Infrastructure Programme (PIP), which was initiated by the Irish government in 1997, and the Irish Centre for Research in Applied Geosciences — established in 2015.

Ireland has a relatively low number of exploration wells, especially in recent years. We have moved out of the option phase with many licences, but we would expect to see further exploration wells to be developed over the coming years. The Porcupine space remains a relatively unexplored and developed resource.

The PIP study on Ireland’s stratigraphic nomenclature is designed to construct an updated stratigraphic framework for all basins offshore Ireland. It includes an integrated analysis of lithology, biostratigraphy and seismic data currently being secured by the Merlin Energy Resources Consortium. Collins makes specific reference to the ObSERVE programme which is helping scientists to better understand the ecosystems that exist in the waters around Ireland. “It is vitally important that we fully understand the ecosystems that exist within our oceans,” he says.

Collins also believes that the prospective Climate Emergencies Bill 2018 would not help to cut Ireland’s greenhouse gas emission levels nor would it change Ireland’s use of fossil fuels, before adding: “What it will do is force Ireland to progress to only importing its energy at a time when EU production is declining rapidly. Meanwhile, it will potentially increase emissions as we will have to import our oil and gas needs.”

Collins concludes: “Offshore exploration continues to serve Ireland’s energy policy goals. It helps to improve the country’s security of supply and operates within context of the energy transition. Ireland’s offshore is under-explored in terms of drilling. Licensing structures, research activities, and seismic data highlight the petroleum potential of the basins. It is anticipated that this will translate into exploration activity in the medium term.

“Exploration interest in Ireland’s offshore basins remains strong. Out of 25 two-year licence options awarded in 2016, as a result of the 2015 Atlantic Margin Licensing Round, operators of 20 licence options have applied to the Department to convert to frontier exploration licences.”