Single Euro Payments Area (SEPA): looms large on the Irish horizon

As the EU Commission legislates an end date for National Payment Schemes, John Hand looks at its likely impact on the Irish payments landscape.

As the EU Commission legislates an end date for National Payment Schemes, John Hand looks at its likely impact on the Irish payments landscape.

The European Commission is giving its vision for the creation of an internal market for payment services in euro a final push.

This vision expects that the Single Euro Payment Area (SEPA) will provide European citizens and businesses with competitively priced, user-friendly payment services in euro. SEPA is expected to create a market for euro payment services where there is effective competition and there is no difference between the processing of cross-border and national payments. The goal of SEPA is to promote the development of the EU’s internal market by creating a cohesive market for payments with greater transparency, lower transfer costs and reduced execution cycles.

The Commission is disappointed that, although the euro as a common currency has enabled cash payments between EU Member States since 2002, electronic EU wide standard euro payment instruments have not, as yet, replaced national payment instruments. Whilst many citizens and businesses are already familiar with using SEPA payment instruments, based on the use of the BIC (Bank Identifier Code) and IBAN (International Bank Account Number), for cross-border payments, only a few countries have introduced SEPA payment instruments to replace national payments.

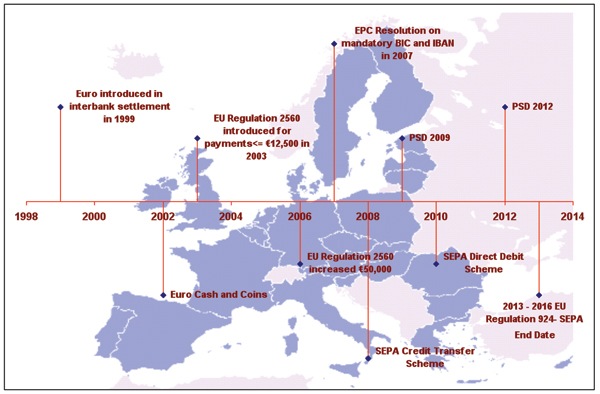

The implementation of SEPA at a national level is probably the largest and most complex project in the history of pan- European monetary initiatives. Since the introduction of the euro in 1999, it represents the latest stage in the Commission’s plans to achieve a common financial marketplace. (See SEPA road map diagram overleaf of key payment initiatives since 1998).

Although the European Banking Industry has developed pan–European payment schemes for SEPA Credit Transfers (SCT) and SEPA Direct Debits (SDD), these schemes only account for 10 per cent of all euro payments within the EU. The Commission estimates that, at the current rate of adoption, it would take 30 years to complete the transition to SEPA. Accordingly, it has decided to legislate an end date for the transition of national payment instruments to the SEPA instruments.

The final push

On 16 December, 2010 the Commission published a proposal for an EU regulation entitled as follows: “Establishing technical requirements for credit transfers and direct debits in euros and amending Regulation (EC) No 924/2009”*. The primary purpose of this regulation is to enforce the closure of legacy national euro payment schemes across the EU in favour of schemes based on SEPA standards.

In Ireland, this would lead to the closure of national payment schemes based on the current NSC (National Sort Code) and Account Number standard in favour of the SEPA Credit Transfer and Direct Debit schemes based on BIC and IBAN (or possibly IBAN only) standards.

The Commission’s explanatory memorandum accompanying the draft regulation indicated that banks and their customers would have approximately 30 months to prepare for the migration from existing legacy national credit transfer schemes to the SEPA schemes and a further 12 months for direct debits. The draft regulation indicated that it would become effective for credit transfers 12 months after entry into force of the regulation and after 24 months for direct debits.

However, since issuing its proposal relating to SEPA last December the Commission has continued to consider submissions from various bodies representing consumers, business and the banking industry alike.

Probable end dates for legacy national payment systems

At the time of writing this article, it appears that the Commission’s proposal will be amended to stipulate that all legacy national payment systems (both credit transfers and direct debits) be converted to SEPA within 24 months of the adoption of the legislation. It is therefore expected that the end date for the national schemes will be a date in early 2014.

SEPA – Now ready for completion

The Commission’s draft regulation was a signal of their intent to complete their vision for the Single Euro Payments Area. The European banking industry has struggled to achieve its commitment to the Commission to deliver the SEPA project due to its inability to convince the other stakeholders affected by the project of the wider benefits of SEPA. The SEPA project has always been a politically motivated project and the banking industry has lobbied the politicians to deliver the legislation that will enable them to complete it.

The amended draft regulation appears to sound the death knell for national legacy payment schemes. Whilst there is still potential that the regulation could be further amended or have the end date extended, it would be foolhardy not to plan to move to the SEPA standards by the end of 2014. Even if the regulation is amended or extended (which now appears unlikely), the SEPA standard payment instruments are here to stay and they provide businesses with a standard payment format for all their euro payments across the EU and EEA whether cross border or national.

Impact on Irish Public Sector

With the end date now indicating an early 2014 date, the following questions should be asked:

• What impact does this have on the payments functions in my organisation?

• When can my organisation be ready?

• What steps should my organisation take?

Therefore, the following high-level checklist should be considered:

• Does my Payroll, ERP or Account Payables system support the new BIC and IBAN standard? If not, what plans do the IT vendors have to upgrade their system and what would be involved?

• Does my Payroll, ERP or Account Payables system automatically initiate payments to employees and or suppliers? Does my bank support or plan to support the initiation of bulk payments based on the SEPA standards? When will these services be available?

• Can I obtain the BIC and IBAN details of my employees and suppliers, if they have not already provided them?

• If my bank already provides national payment instruments based on SEPA standards what steps can we take to migrate our payments and collections to the new instruments to avoid a “Big Bang” conversion task.

• Do I quote my BIC and IBAN on payment demands? This is an existing legal requirement of which many organisations are unaware.

• Do I use Direct Debits to collect funds? What are the implications of the new schemes on my business model?

It is clear that the introduction of SEPA will affect most organisations. The extent of the impact will vary depending on their payment and collection requirements. In any event, it is recommended that an early assessmen

t and engagement with all internal and external stakeholders in relation to SEPA will pay dividends in the long run – in other words Bí Ullamh!

John Hand is a Senior Relationship Manager with AIB Corporate Cash Management, which is part of AIB Global Treasury Services. Contact details: +353 (0)1 6417125 or john.l.hand@aib.ie