State-owned enterprise at a crossroads

New Era must be implemented in a coherent way that ensures the sustainability of the Irish economy according to University of Limerick economists Donal Palcic and Eoin Reeves.

The future of public enterprise and the question of privatisation have become hot topics in the past few months. A number of recent government announcements have confirmed that the sale of shares in state-owned enterprises (SOEs) will form part of the response to the current fiscal crisis. At the time of writing the troika have arrived in Dublin for one of their periodic reviews of how Ireland is performing vis-à-vis the programme it agreed with the Irish Government at the end of 2010. We have been told that part of this review will include discussions about the use of proceeds from the privatisation of SOEs. At the same time however, the Government has announced the establishment of NewERA, which promises to channel funds for investment in infrastructure through a number of newly configured SOEs.

The precise mix of public and private ownership and the role of SOEs is therefore uncertain and our policy-makers face a host of important decisions over the coming months. The fact that these decisions will require approval from our economic masters in the troika is a stark example of Ireland’s loss of economic sovereignty and it is far from clear that the troika’s demands with regard to this sector will serve the long term interests of the Irish economy.

When sovereign nations choose to privatise government held shares in SOEs, it is generally done for the following reasons:

• to improve the performance (and efficiency) of the individual enterprise;

• to raise revenues for the exchequer; or

• to achieve certain distributional objectives (for example, widen share ownership by selling shares to ordinary citizens).

There is an inherent tension between these objectives. For example, exchequer proceeds will not be maximised if large amounts of shares are sold at a discount in order to attract small shareholders. As all three objectives cannot be satisfied simultaneously, economists tend to attach most importance to the objective of improving enterprise performance. On this score, the basic argument in favour of privatisation is that a change to private ownership will improve performance because private sector management is superior to its public sector counterpart. Such arguments hold sway in some influential and important circles. Our Minister for Finance, Michael Noonan, recently told the Dáil that the European authorities believed and were backed by “any economic theory you’d like to read” that “assets in private hands will be used more efficiently for the public good than assets in public hands in general terms”.

Two key issues in relation to the Minister’s statement need to be addressed. The first is that the assertion is simply incorrect. The theoretical and empirical literature on privatisation indicates that improved efficiency is only likely where privatised enterprises operate in product markets that are competitive. In Ireland, the main companies that remain under public ownership (e.g. Bord Gáis, ESB, DAA) operate in markets where competition is limited or non-existent. The potential for improved performance following the privatisation of such companies is therefore limited.

The second concerns government policy on SOEs. Only days before the Minister’s statement, the Government launched its New Era plan for mobilising investment and job creation in the Irish economy. Given his assertion about the superiority of private enterprise one would expect privately owned companies to lead the way in re-invigorating our beleaguered economy. But New Era plans to establish four new network companies under public ownership. These companies will control the networks and invest in the electricity, gas, water and telecommunications (broadband) sectors.

Economic stimulus

Aside from the obvious inconsistency between the Minister’s comments and government policy, New Era makes a lot of sense. The prospects for the Irish economy continue to be undermined by low levels of public capital stock and, in many cases, poor-quality infrastructure. Assuming capital investment plans pass the relevant cost-benefit analysis tests, the case for the broad investment plans contained in the New Era plan is compelling. The long run sustainability of the Irish economy depends critically on the kind of investment envisaged by New Era. Not only does New Era have the potential to provide much needed stimulus for the Irish economy by giving domestic demand a much needed kick-start, it also has the potential for improving the supply side of the economy and creating the capacity for sustainable growth in the years ahead.

However, there is no guarantee that New Era will be implemented along the lines originally articulated when Fine Gael first published it.

The principal constraint is the availability of funds. The revenue accrued from the privatisation of non-strategic state assets had been earmarked as one source of funds but room for manoeuvre is limited as it appears that the Troika expects privatisation proceeds to be used to pay down our enormous national debt.

If the following original New Era commitments are to be implemented, there are a number of problems to be overcome.

The establishment of a new State company ‘Smart Grid’, which involves the merger of Eirgrid and ESB Networks.

Fine Gael’s original plan envisaged splitting up the ESB, selling off assets such as ESB International and ESB Powergen and Supply, and retaining the network assets in public ownership. Given the original plan, the recent decision to partially privatise the ESB as a fully integrated network utility is bizarre and raises obvious questions as to how the Government plans on progressing the ‘Smart Grid’ element of its New Era plan.

The establishment of ‘Broadband 21’, which will invest in the roll out of high-speed fibre infrastructure across the country.

The plan envisages the amalgamation of existing telecoms network assets held by Bord Gáis, CIÉ, ESB and the metropolitan area networks to create a national open access next generation broadband network. The Government will need to resolve how to invest in the roll out of fibre in the critical “last mile”, most of which is owned by eircom. While the New Era plan envisages co-investment in infrastructure with the private sector, it is impossible to see how the almost bankrupt eircom will be able to invest significantly in the upgrading of its last mile infrastructure. It is therefore likely that significant public funds will be required.

The establishment of Gaslink, which will involve the amalgamation of Bord Gáis Networks with Gaslink, the existing operator of the gas network.

This proposal is similar to that of ‘Smart Grid’. As with the recent decision on the partial privatisation of the ESB, whether or not the proposed merger of Gaslink with Bord Gáis Networks is likely to go ahead depends on whether or not the Government decides to sell a partial stake in Bord Gáis as a fully integrated company.

Considering these challenges, the implementation of New Era’s ambitions will require a clear vision of the future role of the SOE sector in the Irish economy. Recent announcements and statements on privatisation and the role of public enterprise, however, demonstrate a degree of incoherence that creates uncertainty about the precise details of intended reforms. This can, in part, be attributed to the constraints placed on economic policy by virtue of our loss of economic sovereignty. The future direction of the SOE sector therefore depends critically on how our representatives perform in their ongoing dealings with our economic masters.

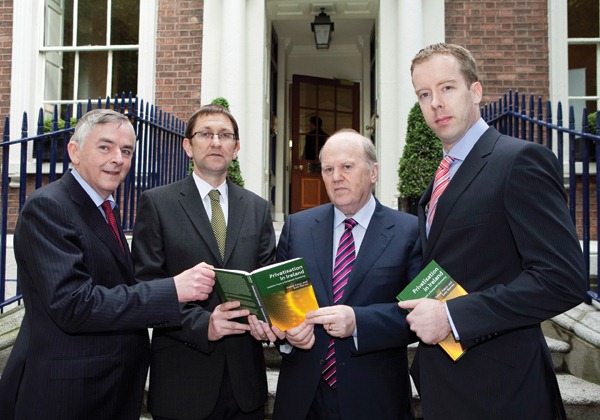

Palcic and Reeves are members of the Privatisation and PPP Research Group at the University of Limerick and authors of ‘Privatisation in Ireland: Lessons from a European Economy.’