The sustainability challenge

Senior Economist in the Trade and Agriculture Directorate, OECD, Jonathan Brooks believes there is no question that the world can be fed over the next 10 years but does ask: at what price?

“Prices matter,” he says, “They are an important driver of the real incomes of producers and consumers. However, even rock bottom prices won’t be enough to ensure access of the poorest. Their problem is income generation. Looking ahead, there may well be wide uncertainties on each of the supply and demand shifters, and hence on prices.”

Brooks adds that long-term drivers can be overwhelmed by bouts of international price volatility. “There is a need to work on both supply and demand dimensions to improve global food availability.”

The OECD representative added that the world’s population is expected to reach 9.7 billion by 2050.

“That’s 30 per cent higher than now, with China and India contributing to this growth in a significant manner. Rising incomes will raise demand for livestock products and animal feed but the world’s population will be more urban with 50 per cent of all people living in mega cities. Non-food demand for products such as fuel and fibre will also increase.

“We will also see food chains becoming longer, more complex and energy intensive. Climate change will have net negative effects on agricultural productivity. There will also be increased pressure on land and water resources.

Brooks admits that the effect of Brexit will have to be factored into the development of the agri-food sectors in the UK and the EU-27 over the coming years but says “it’s still too early to determine how this matter will evolve”. He adds that global food supply growth continues to outpace consumption.

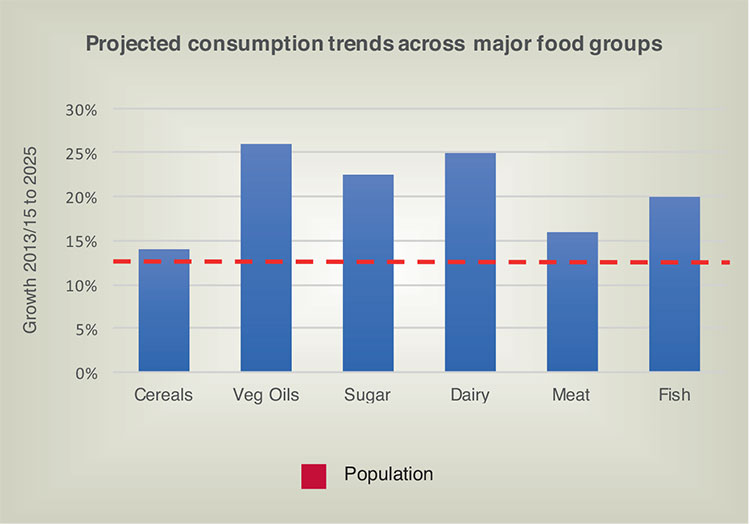

“This will include a strong demand growth for meat, fish and dairy products. Food consumption of cereals may well stagnate and we will see a shift toward livestock products. In turn, this will induce an additional need for feed crops, particularly coarse grains and protein meals. A strong increase in sugar and vegetable oil consumption is also envisaged.”

According to Brooks, increasing consumption in developing countries is projected to reduce the global proportion of people who are undernourished from 11 per cent to 8 per cent over the next 10 years, with the total numbers of undernourished declining from 788 million to less than 650 million. However, undernourishment in Sub Saharan Africa remains high, and in 10 years the region will account for more than one third of the global total of undernourished, compared with just over a quarter today.

“Many countries will be confronted with a complex burden of undernourishment (too few calories), obesity and micronutrient deficiency (with unbalanced diets a common problem). In both developed and developing countries, consumption of sugar, oils and fats is projected to increase faster than consumption of staples and protein, largely as a result of people consuming more processed food products.”

Brooks confirmed that the increased demand for food is projected to be satisfied through productivity gains, with modest changes in crop area and livestock herds. Yield improvements are projected to account for 80 per cent of the increase in crop output. He said there is some scope to increase agricultural area sustainably, mainly in parts of Latin America and Sub-Saharan Africa.

“With overall market growth projected to slow, agricultural trade is expected to expand at about half the rate of the previous decade. For most agricultural commodities, global exports are concentrated among just a few key supplier countries. For all products covered by the Outlook, the five main exporters will account for at least 70 per cent of total exports, with just two or three countries dominating supplies of some commodities.”

He continues: “With supply and demand growth broadly matched, real agricultural prices are projected to remain relatively flat. However, there will be some relative price changes that reflect adjustments in the composition of demand, as well as differences in supply conditions, such as the comparative ease of increasing production in Latin America relative to Asia.

“Overall, livestock prices are projected to rise relative to crop prices, and the prices of coarse grains and oilseeds are projected to rise relative to the prices of food staples. Those structural trends are likely to be more apparent in the current context of lower prices across all commodity groups.”

Brooks indicated that all future projections are subject to a wide range of uncertainties, including variations in oil prices, yields and economic growth.

“If historical variations in these factors continue, then there is a strong chance of at least one severe price swing within the next 10 years. Such wide inter-annual price movements can mask long-term trends. Climate change may add to this uncertainty, especially if the occurrence of extreme weather events intensifies.”

Discussing the ways by which global food availability can be increased, he states: “Improved agricultural productivity through the more efficient use of inputs, such as labour, land and water, will be critical. An expansion of land area will be part of the mix, as will be reduced consumer waste. Reducing supply chain losses will also be critical moving forward while the challenge of climate change adaptation must be addressed. We also need to see less diversion of crops to non-food uses. When it comes to limiting food demand, reducing food wastage will be a very important element in the period ahead.”

Where future sustainability is concerned, the OECD analyst believes there is more scope for raising yields.

“Much of the world’s population lives in areas of severe water stress, and water is not used sustainably, but pricing natural resources for sustainable use may imply trade-offs with immediate food security. Sustainable intensification is necessary. This will entail the attainment of improved water management and the wider use of no-till farming techniques. Agriculture’s contribution to climate change mitigation is a major uncertainty.”

Commenting on the outlook for international trade practises, Brooks explains that most food is produced and consumed domestically.

“However, areas of demand growth do not equate areas where production can be increased sustainably. Many countries will require imports to meet their additional food needs, especially in Africa and South Asia.

“A few key exporters will supply those growing import demands but it’s imperative that these exporters are reliable suppliers.”

Turning to the import side of the equation, Brooks says there is less concentration, although China is a critical market for some commodities.

“This is particularly the case for soybeans, but also dairy products and coarse grains other than maize.” He adds: “The food import dependency of resource poor regions, especially North Africa and the Middle East, is projected to intensify.”

Stressing the role which volatility will continue to play on world commodity markets, Brooks says: “It will continue to represent a source of uncertainty, which is not helpful. Volatility from oil prices, economic growth, exchange rates and yield variations are other factors to be considered. Climate change will add to all of these pressures. Policy-induced uncertainty will compound volatility. In fact, a crisis is more likely when the wrong policies compound volatility.

“Brexit is another factor that will add to the complexity of predicting and assessing the potential for agriculture in the UK and Ireland. The pending negotiations represent a key element of uncertainty for the industry as it looks to the future.”