TRADE UNION DESK Explainer: Changes to your State Contributory Pension

Laura Bambrick, the Irish Congress of Trade Unions’ (ICTU) spokeswoman on pensions explains what you need to know about the compromise changes to the State Contributory Pension aimed at bridging the gap between pension expenditure and the Social Insurance Fund’s resources.

Plans to raise the State Pension qualifying age to 67 in 2021 and to 68 in 2028 had become a key battleground during the 2020 general election and had the biggest influence on how people voted, after health and housing. Voter awareness had been raised by the SIPTU-led Stop67 campaign.

In response, the subsequent (now outgoing) government agreed to keep the qualifying age at 66.

Unions have never denied the challenge Ireland’s rapidly ageing population presents for the future sustainability of the public finances if no policy change is made. However, the planned increases to the State Pension age went too far, too fast and would have amounted to the biggest ever cut to the social safety net for working people.

Here is what you need to know about the compromise changes to the State Contributory Pension to close the gap between anticipated pension expenditure and the Social Insurance Fund’s resources.

The more you put in, the more you get out

The current formula for calculating your payment rate will be gradually phased out over a 10-year period starting from January 2025. This change is intended to strengthen the link between what you put in (PRSI contributions) and what you get out (payment rate).

Under the new method, you will need 2,080 weekly PRSI contributions, equivalent to 40 years, to qualify for the full payment rate (€289.30). These can be a mix of paid contributions and credits (see Box 1).

If you have fewer than 2080 contributions, you will receive a pro-rata payment of 1/40 of the full rate for every 52 contributions. As is currently the case, you must have at least 520 paid contributions to qualify for the State Contributory Pension.

Box 1: Paid contributions and creditsYou and your employer pay a percentage of your weekly earnings into the Social Insurance Fund, which funds contributory social welfare benefits such as Maternity Benefit and the State Pension. With few exceptions, the payment of PRSI (Pay-Related Social Insurance) contributions is compulsory. One paid contribution is recorded for each week. For example, after a full year you will have built up 52 paid contributions. You are entitled to credits (credited contributions) if out of work for specified reasons such as unemployment or illness. You can receive up to 520 credits, equivalent to 10 years, for non-caring related gaps in employment over your working life. If you have taken a career break to care for a young child (under age 12) and/or an incapacitated older child or relative you can claim up to 1040 credits, equivalent to 20 years. Case scenario: ‘After her maternity leave Orla took a period of unpaid maternity leave. She can claim maternity leave credits by having her employer complete a form when she returns to work (link to application form for maternity leave credits).’ |

Work longer for even more

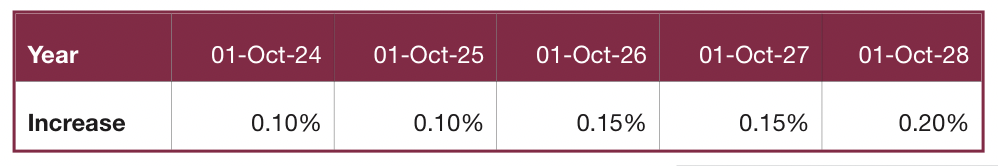

To incentivise workers to continue working past 66, you can now choose to delay claiming your State Contributory Pension until any age between 67 and 70 in return for a higher weekly payment rate when you claim it (see Table 1).

Table 1: What you will get if you delay claiming your State Contributory Pension

*The rates will be set in the budget each year and based on actuarial factors, which will be reviewed every five years in line with the actuarial review of the Social Insurance Fund.

This new deferred pension option also allows people who are short of the minimum 520 paid PRSI contributions needed to qualify for the State Contributory Pension or the 2,080 contributions needed to qualify for the full payment rate to continue working and pay PRSI up to age 70 to improve their contributions record (see Box 2).

Box 2: How to check your PRSI contributions recordIt is now quick and easy to check how many PRSI contributions you have paid or credits you have received towards your Contributory State Pension. Anyone, whether you are preparing for retirement or just starting out in your career, can request their record of contributions, known as a contribution statement, on MyWelfare.ie or you can email: contributionstatement@welfare.ie. |

Ending forced retirement

New legislation, when it is passed by the new members of the Oireachtas, will allow private sector workers to remain in their job until age 66. Unions have long argued that there is a sizeable and growing number of workers who are forced to retire earlier than they would wish because of a compulsory age of retirement in their employment contract, typically 65.

Most public servants already have the right to continue in their job up to age 70 (and some beyond that) if they wish, subject to suitability and good health.

Revenue raising

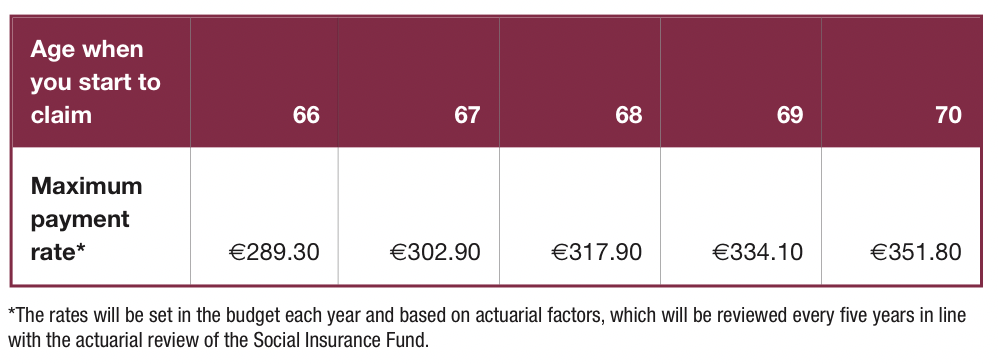

PRSI contribution rates for workers, employers and the self-employed will be gradually increased by 0.7 percentage points over the next five years (see Table 2). Since 1 October 2024, the employee PRSI rate of 4 per cent increased by 0.1 per cent to 4.1 per cent when the first increase kicked in. For example, if you earn the average weekly wage (€970) you will be paying an extra 97 cents a week or €50.44 over the next year in PRSI.

After five years, from 2028 onwards, an extra €6.79 a week or €353.08 a year in PRSI will be deducted from your wages. The additional income raised from this hike (€1.6 billion per annum from 2028) will build up the Social Insurance Fund surplus while Ireland still has a young population – with five people of working age for every pensioner – in preparation for the not-too-distant future when we will not.

Table 2: PRSI increases from 2024 to 2028